Data logger is an electronic device that mechanically monitor and record operational and environmental parameters of vehicles over time, allowing the measurement documentation, analysis, and validation of several conditions such as temperature, humidity, and current. The data logger contains a sensor to receive information and a computer chip to store it. This information is stored in the data logger and is subsequently, transferred to a computer for analysis.

Market Dynamics – Automotive Data Logger Market

The automotive industry is observing rapid transformation, leading to the rise of connected and autonomous vehicles. These vehicles create huge amounts of data through a network of sensors deployed on-board. Vehicle data holds great potential for OEMs to create new revenue paths and increase the potential of connected vehicle capabilities such as usage-based insurance (UBI), real time analytics, data marketplaces/monetization and beyond. These new potential revenue sources and increasing popularity of connected vehicles is boosting the demand for data loggers for testing, performance evaluation, and data gathering. These multiple applications are driving the global automotive data logger market.

ECONOMIC IMPACT OF COVID-19 ON AUTOMOTIVE DATA LOGGER MARKET

The exclusive COVID 19 impact analysis provides an analysis of micro and macro-economic factors on the Automotive data logger market. Also, complete analysis of changes on automotive and electronic expenditure, economic and international policies on supply and demand side. The report also studies the impact of the pandemic on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market.

AUTOMOTIVE DATA LOGGER MARKET - SEGMENTAL OVERVIEW

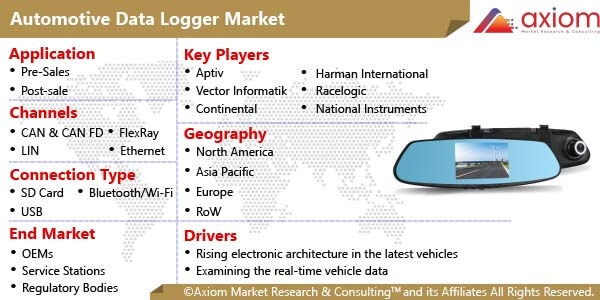

The study analyses the global automotive data logger market based on the application, channel, connection type, end market, and geography.

AUTOMOTIVE DATA LOGGER MARKET BY APPLICATION

The market finds application in pre-sale and post-sale. The pre-sale segment held a lion’s share in the market. This would be because data loggers are widely used in the automotive industry at this stage because of their ease of use and the understandability and reliability of the collected information. They also reduce the efforts of original equipment manufacturers (OEMs) during lab testing and on-road testing and their go-to-market time for new products and technologies.

AUTOMOTIVE DATA LOGGER MARKET BY CHANNEL

CAN & CAN FD, LIN, FlexRay, and Ethernet are the channels of the automotive data logger. The CAN & CAN FD segment is anticipated to dominate the market share over the forecast period. CAN & CAN FD is a data-communication protocol typically used for broadcasting sensor data and control information on two-wire interconnections between different parts of electronic instrumentation and control systems. Through CAN & CAN FD, automakers can transmit data and allow communications at speeds of 1 Mbps with a high level of data integrity. Thus, the category is expected to retain its dominant position during the forecast period.

AUTOMOTIVE DATA LOGGER MARKET BY CONNECTION TYPE

SD Card, USB, bluetooth/Wi-Fi and cellular modem are the various typed of connections use din vehicles for data logging. The SD Card segment is likely to be the fastest growing segment in the market. However, the SD card segment is estimated to witness a rise in the growth of the market as it is convenient, inexpensive, and reduces the possibility of data loss.

AUTOMOTIVE DATA LOGGER MARKET BY END MARKET

OEMs, service station, regulatory bodies are the end market of the automotive data logger. The regulatory bodies segment is anticipated to hold the largest market share, by end market. This can be attributed to the fact that the industry is moving ahead in the direction of self-driving and environment-friendly vehicles. Consequently, the older regulations and rules need revision, and several new laws and regulations need to be created. For this, the governing bodies would be required to understand the operation of these modern vehicles appropriately, which calls for the usage of data loggers at their test centers.

AUTOMOTIVE DATA LOGGER MARKET BY GEOGRAPHY

Geographically, the study is comprised of the key countries of North America, Europe, Asia-Pacific, and the Rest of the World. Asia Pacific is the fastest growing the global automotive data logger market. In recent years, APAC has emerged as a hub for the adoption of advanced features in automobiles. Furthermore, industrialization and the infrastructure developments in the region are creating numerous opportunities for automotive OEMs. Furthermore, with the increase in the adoption of advanced electronic components in the vehicle architecture and during the testing of vehicles before their commercialization, the market is set to witness a boom in the region.

AUTOMOTIVE DATA LOGGER MARKET KEY PLAYERS

The key competitors of this market include Moog, Aptiv, Vector Informatik, Continental, Harman International, Racelogic, National Instruments, Tttech Group, Horiba, Xilinx, and among others.