PVB or polyvinyl butyral interlayers are films that bonds with glass under pressure and heat to form laminated safety glass. High quality PVB interlayers improves glass’s security, safety, strength, style, solar/UV control, and sound control. These interlayers were developed specially for automotive applications to minimize head-impact injuries in car accidents. And over 90% of laminated safety glass interlayers are made from polyvinyl butyral.

Market Dynamic- North America PVB Interlayers Market

The North America PVB interlayers market is presently being driven by several factors. Growing production and sales of automotive vehicles and improving safeguard regulations are boosting the growth of the PVB interlayers market in the North America region. Besides, rising building and construction projects are further triggering the demand for PVB interlayers in recent times. Likewise, continuous demand for the electricity and energy has reflected positively in the demand of the PVB interlayers and in turn is impelling growth of the North America PVB interlayers market.

COVID 19 Impact on North America PVB Interlayers Market Report

The exclusive COVID 19 impact analysis report by Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the PVB interlayers market. In addition, complete analysis of changes on PVB interlayers market expenditure, economic and international policies on supply and demand side. The report also studies the impact of pandemic on North America economies, international trade, business investments, GDP and marketing strategies of key players present in the market. COVID-19 pandemic has negatively impacted end use industries such as automotive, construction and photovoltaic industries. This is owing to the shutdown of various North America automotive manufacturing facilities and shortage of labor force and raw materials during early pandemic period.

North America PVB Interlayers Market Segmental Overview

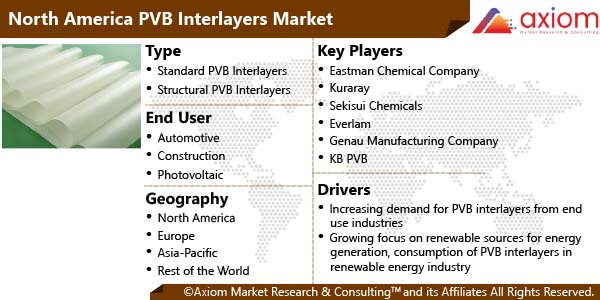

The study analyses North America PVB interlayers market based on type, end use industry and country.

PVB Interlayers Market by Type

Two major types such as standard PVB interlayers and structural PVB interlayers are analyzed in the North America PVB interlayers market. The standard PVD interlayers segment dominated the market in 2020 and is expected to maintain its dominance during the forecast period. However, structural PVB interlayers segment is expected to witness rapid growth in the coming years. An increasing demand for structural polyvinyl butyral interlayer for applications where high glass adhesion and interlayer rigidity requirements are not met with standard glazing interlayers is attributed to the growth of the segment.

PVB Interlayers Market by End Use Industry

Major end use industries of the North America PVB interlayers market are automotive, construction and photovoltaic. The automotive end use industry is expected to dominate the market during the estimated period. On the other side, photovoltaic segment is likely to be the fastest-growing end-use industry segment of the PVB interlayers market. The photovoltaic industry is growing rapidly with the growing demand for solar energy. PVB interlayers have many benefits than other plastic materials when used as an encapsulant in photovoltaic devices. PVB sheets and films are anticipated to witness a healthy increase in demand in the near future owing to their use in ground transportation, solar energy, and building and construction.

PVB Interlayers Market by Country

Country wise, the study is comprised of the key countries of such as the US, Canada and Mexico. The United States likely to dominate the North America PVB interlayers market during the estimated time frame. Rapid growth in the country’s automotive, photovoltaic and building and construction industry is propelling the growth of the market. For instance, according to the Solar Energy Industries Association (SEIA), the United States has installed 5 GW of solar PV capacity in Q1 2021 to reach 102.8 GW of total installed capacity, enough to power 18.6 million American homes.

PVB Interlayers Market Key Players

The major key players of market include Eastman Chemical Company, Kuraray, Sekisui Chemicals, Everlam, Genau Manufacturing Company, KB PVB, Chang Chun Group, Dulite Co.Limited, Huakai Plastic Co., Ltd, Willing Lamiglass Materials, Jiangsu Darui Hengte Technology and Tiantai Kanglai Co., Limited among others.

Recent Developments :

March 2021: Eastman Chemical Company announced it is making an investment to expand and upgrade its extrusion capabilities for production of interlayers product lines at its Springfield, Massachusetts, manufacturing facility. The investment will strengthen the company’s supply capability to respond to global and regional demand for Saflex polyvinyl butyral (PVB) products in the architectural and automotive markets.

January 2021: Kuraray announced that it is continuing to invest in its Czech production site in Holešov. The investment will expand the manufacturing of its SentryGlas product, the film for glass interlayers made of ionoplast and will enable the plant to manufacture the class-leading interlayer on rolls widths up to 330 cm.

November 2020: Eastman Chemical announced the partnership with Seen, a Swiss architectural-surfaces specialist, to market a line of bird-safe interlayers for laminated architectural glass. The partnership fits in with the company’s current business in polyvinyl butyral (PVB) interlayers for automotive and architectural safety glass.