COVID-19 Impact Analysis on Asia Pacific Zircon Sand Market

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360-degree analysis of micro and macro-economic factors on the Asia Pacific zircon sand market. In addition, complete analysis of changes on the Asia Pacific zircon sand market expenditure, economic and international policies on supply and demand side. The report also studies the impact of pandemic on regional economies, international trade, business investments, GDP and marketing strategies of key players present in the market. The COVID-19 impacted various end use industries of the zircon sand market in the APAC region. The nationwide shutdown and the lockdowns of non-essential industries have caused a downfall in the economy. Several construction activities and projects, including government infrastructure projects, commercial and residential projects which were initially running, were completely stopped due to lockdowns regulations. The region’s construction sector witnessed some major difficulties with labor shortages, material supply chain disruption, and the city-wide lockdown or shutdown of construction sites. The region’s construction market depends heavily on national shipments of construction materials. Thus, surged supply chain disruption during the COVID-19 pandemic has negatively affected the region’s construction industry. This is in turn hindered the growth of zircon sand market across the region.

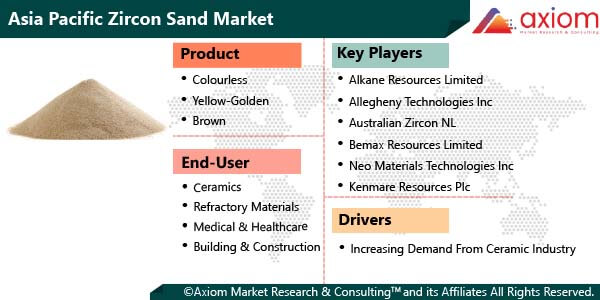

Market Overview- Asia Pacific Zircon Sand Market

Market Drivers

Increasing production of zircon sand in the Asia Pacific countries such as China, Australia and India is attributed to the market growth. Zircon sand is a naturally occurring mineral, used in several strategic industries. The largest global deposits are found in Australia, S. Africa but with smaller volumes in China, S.Asia, and India. Zircon sand can be used directly in certain foundry applications or fine milled to produce zircon flour. Zircon sand is largely consumed as an opacifier, and has been acknowledged to be used in the decorative ceramics sector. Other applications include use in foundry casting and refractories and an increasing range of specialty applications as zirconium and zirconia chemicals, including in catalytic fuel converters, nuclear fuel rods, and in water and air purification products.

Market Opportunity

Booming consumer electronics industry across the region and surge in the demand of consumer electronics products as computers, TV, etc., is also likely to create more demand for zircon sand in the coming years. Zircon sand is a major raw material used in the manufacture of glazes, opacifiers, and frits, decorative tiles and floor, steel refractories and glass, specialized glass and metal castings. Consumption of zircon products in the production of faceplates for computer screens and TV monitors continues to rise, especially in developing countries. The improved use of zirconia and zirconium chemicals in numerous applications continues with China being in the forefront of new production facilities to service these industries. Thus, zircon has an exceptional collection of physical properties which make it ideal for an extensive range of demanding and high temperature applications.

Market Restraints

Factors such as gap between demand and supply is expected to hamper the zircon sand market. Moreover, high tariffs and stringent mining policies are anticipated to hinder the zircon sand market. From the past few years, there has been a global increase in regulation within the areas of the transport, environment, and health and safety. Regulations are becoming more stringent, whilst seeing a global trend in harmonization.

Market Growth Challenges

Increase in prices of zircon sand is likely to restrict the market growth in the coming years. For instance, there has been a steady increase in zircon sand pricing on the back of Iluka Resources raising their prices by USD 70/mt for Q2 2021 deliveries. Other key producers, such as Tronox and RBM, have followed suit and raised their prices by a similar amount. Prices now stand at about USD 1490-1520/mt CIF China port. Prices are expected to continue upwards heading into Q3 owing to a healthy demand for downstream zirconium products.

Cumulative Growth Analysis

The report provides in-depth analysis of Asia Pacific zircon sand market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. Booming end use sectors across the Asia Pacific region and rising demand for zircon sand from ceramic industry is expected to contribute to the market growth.

Market Segmental Overview

The Asia Pacific zircon sand market is bifurcated into product, end-use industry and country.

ASIA PACIFIC ZIRCON SAND MARKET BY PRODUCT

The Asia Pacific zircon sand market is studied for various products such as colourless, yellow-golden, brown and others. The colourless segment is expected to account for the major market share and is anticipated to grow with a significant share. The factors can be accredited to its high demand in end-use industries. Zircon sands are rounded, naturally occurring sands used in refractory, ceramic, foundry, and precision investment casting applications. They are important components in the production of ladle brick, glazes, coatings, wall tiles, shell molds and cores, and metal chills. Thus, an increasing use of zircon sand in refractory, the steel foundry industry, weld fluxes and ceramics application is accredited to the growth of the market.

Asia Pacific Zircon Sand Market by End-Use Industry

The report analyses various end-use industries of zircon sand such as ceramics, refractory materials, medical & healthcare, building & construction and others. The building & construction and ceramic are major segments of the zircon sand market by end-use industry. This is primarily accredited to the surge in the investment in the building & construction industry across the globe. In addition, increasing use of zircon sand in ceramic industry is also likely to fuel the growth of the market in the coming years. Advanced ceramics is a well-known commercial application for zircon sand. Traditional ceramics, such as bricks and clays, are usually porous, hard, and brittle. Advanced ceramics refers to ceramic materials that have been specially designed to enhance those features.

In addition, during the manufacturing of ceramic tile, zircon sand is mostly used in the form of flour. Zircon sand is sometimes used to enhance abrasion resistance of glazed surfaces, particular floor tiles. The characteristics that make zircon an ideal opacifier are its high refractive index. Fine zircon grains also scatter visible light, making ceramics appear opaque and white. An additional characteristic that makes zircon sand attractive for ceramic manufacturing is its high hardness, which helps to resist mechanical damage and scratching.

Asia Pacific Zircon Sand Market by Country

The report analyses various countries of the Asia Pacific regions such as China, India, Japan and rest of APAC. The market in China is expected to grow at the highest CAGR during the forecast period. Countries such as India and China are expected to dominate the market in the coming years. China is one of the fastest growing economies across the globe, and most of the end-use industries in the country are anticipated witness significant growth owing to its increasing population and enhanced standard of living. China is observing rapid growth in the nuclear power plant, which is anticipated to improve the demand for zircon. Additionally, China is one of the leading market leaders of the ceramic sector. The steel and iron industry consumes the major part of refractories. The steady growth in the manufacturing of steel and iron has been propelling the market growth. The growth of industries such as foundry, ceramic, and refractories is projected to impel the market growth during the projected timeframe.

Competitive Landscape Analysis

The zircon sand market is witnessing high competition owing to presence of many major players in the market. The key companies operating in the zircon sand market are catering to the demand by collaborating, innovative, acquiring small players. Some of the major companies operating in the market are Alkane Resources Limited, Allegheny Technologies Inc, Australian Zircon NL, Bemax Resources Limited and V.V Mineral among others. A majority of the consumption of zircon sand is based in China and Australia.

The key players studied in market are Alkane Resources Limited, Allegheny Technologies Inc, Australian Zircon NL, Bemax Resources Limited, New Energy Holdings Limited, Tronox Limited, Zhejiang Jinkun Zirconium Industry Company Limited, Doral, East Minerals, V.V Mineral and Iluka Resources among others.