COVID-19 Impact Analysis on Europe Polyacrylate Rubber Market

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the Europe polyacrylate rubber market. In addition, complete analysis of changes on the Europe polyacrylate rubber market expenditure, economic and international policies on supply and demand side. The report also studies the impact of pandemic on Europe economies, international trade, business investments, GDP and marketing strategies of key players present in the market. In the Europe polyacrylate rubber market was more or less affected due to COVID-19. The market has specifically witnessed the declining sales in 2020 mainly due to impact of COVID-19. The supply was disrupted due to lockdown which was imposed by various government and labor shortage in these industries due to travel restrictions which has affected the polyacrylate rubber market. However, post pandemic and in 2021, the market has specifically witnessed the recovery.

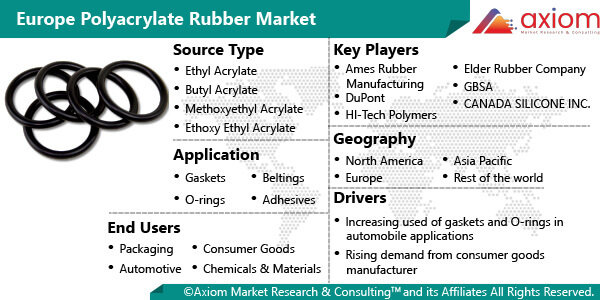

Market Overview- Europe Polyacrylate rubber Market

Market Drivers

Europe polyacrylate rubber market is driven by increasing demand for automation in end-use sectors, such as power plants, chemical plants and manufacturing industries. Polyacrylate rubber is in higher demand than ever before, owing to rising automobile manufacturing and the necessity for long-lasting and high-performance components. The demand for long-lasting and high-performance components. The demand for this material is projected to boost significantly owing to the growing demand for reduced fuel consumption and increased combustion temperature in the engine compartment. For instance, in January 2021, Biesterfled received distribution rights for Denka acrylate rubbers. Biesterfeld had expanded its partnership with Denka Company Limited by taking on the distribution of Denka ER acrylate rubbers with immediate effect. The new agreement applies to the whole of Europe (except Spain and Turkey), Russia and Brazil.

Market Opportunity

The Europe polyacrylate rubber market is expected to witness increasing new growth opportunities for market with growing demand from automotive industry. Polyacrylate rubber is in higher demand than ever before, owing to rising automobile manufacturing and the necessity for long-lasting and high-performance components. The demand for long-lasting and high-performance components. The demand for this material is projected to boost significantly owing to the growing demand for reduced fuel consumption and increased combustion temperature in the engine compartment.

Market Restraints

The disadvantages of acrylic rubber comprise low resistance to moisture, acids, and bases. These limitations restrict the use of acrylic rubber in some applications, thereby hampering the demand for the product. The other disadvantages of polyacrylic rubber comprises not applicable to brake fluid, no low temperature resistance, not suitable for phosphate esters and automotive transmission system and power system seals.

Market Growth Challenges

The major growth challenge for the market is availability of substitutes. Natural rubber is also a type of elastomer, an organic compound and an isoprene polymer derived directly from nature. As of 2019, 13,804 million tons of natural rubber were produced across the region, and exports expects that number to increase. Compared to the long, randomized polymer chain in synthetic elastomers, natural rubber consists of loosely joined, tangled isoprene monomers that can be pulled apart and altered but will still revert to their original shape when the force is removed. Natural rubber is softer than synthetic rubber and other elastomers, making it better for things such as anti-vibration components, springs and bearings, adhesive materials, automotive parts and medical tubing etc.

Cumulative Growth Analysis

The report provides in-depth analysis of Europe polyacrylate rubber market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. With increasing demand for various polyacrylate rubber in various applications has led the increasing demand for market and is expected to witness the growth at a specific CAGR from 2022-2028.

Market Segmental Overview

The Europe polyacrylate rubber market comprises of different market segment like Source Type, End Users, Application and Country.

Europe Polyacrylate Rubber Market by Source Type

The source type studied in the Europe polyacrylate rubber market are ethyl acrylate, butyl acrylate, methoxyethyl acrylate, and ethoxy ethyl acrylate. Ethyl acrylate holds majority of markets share in term of revenue. It is mostly used as a raw material for various applications like fiber processing agents, adhesives, coating, plastics, acrylic rubbers and emulsions. Ethyl acrylate can be chemically manufactured using the several industrial methods. And one of most prominent method followed is to cause the reaction between acrylonitrile and ethanol using the sulphuric acids as the catalyst. Additionally, manufacturer also use phenolic type inhibitors, soluble manages or cerium salts to aids its production.

Europe Polyacrylate Rubber Market by Application

The Europe polyacrylate rubber market finds its major application in gaskets & seals, O-rings, beltings, adhesives, plastics, engine oils and lubricants, piping, and others (coatings, textiles). Gaskets & Seals is expected to gain major market share in 2021 and maintain its dominance over the estimated time period. Gasket play an important role in prevention of fluid leakage from pipes and equipment parts in a wide range of field. As gasket are traditionally used to give a seal between the mating countenances of flanged joint, filling-in surface unpleasantness, unevenness and abnormalities in mating confronts attributable to machining and assembling flaws or impediments.

Europe Polyacrylate Rubber Market by End User

The Europe polyacrylate rubber market finds its major end user in automotive industries, chemicals & materials industries, packaging industries, consumer goods industries. Automotive industry is expected to gain major market share for the polyacrylate rubber market and maintain its dominance over the forecast period. The market compounds have been widely used for number of years for manufacturing oil seals and are used in current high performance automotive engines. As the with changing dynamics in automotive industry the development of these engines often requires new sealing material which in turn support the growth of polyacrylate rubber market. Also, polyacrylate rubber is already known to withstand the use temperature of 150 degree Celsius with adequate oil resistance. The beneficial mechanical performance, particularly the endurance at the service condition is expected to create ample of new growth opportunities for the market over the estimated time period (2022-2028).

Europe Polyacrylate Rubber Market by Country

Geographically, the Europe polyacrylate rubber market is studied across the countries of the UK, Spain, Italy, France, Germany, and Rest of Europe. The UK dominates the Europe polyacrylate rubber market. UK has strong growth in terms of automotive manufacturing since past few years but it is likely to be affected by country’s departure from the EU. UK exports around 70% of its car production volume, out of which around 60% is exported to EU countries. Germany and UK witnessed a slight decline in their automotive production in 2017 mainly because of the peak achieved in 2016 and on account of political uncertainties.

Competitive Landscape Analysis

The competitive landscape analysis of polyacrylate rubber market is certainly based range of market players operating in the material and equipment market with increasing demand for production of polyacrylate rubber. Besides, number of market players offered wide range of products for different application in various geographic locations. The market has major competitive analysis based on new product launches as well as other developments.

The key players studied in market are Ames rubber manufacturing., Dupont De Nemours Inc, HI- tech polymer, Elder Rubber., GBSA, Dowell Rubber Technology, Co. Inc, Specialty Tapes industry., Zeon Corporation, Vanderbit Chemicals LLC, Unimatec Chemicals, among others.

Recent Development:

August 2018: Zeon announced to establish a new subsidiary in Thailand for Acrylic Rubber manufacture and sale. The Thailand operation joins Zeon’s existing Acrylic Rubber manufacturing capabilities in Japan and USA.