COVID-19 Impact Analysis on Global Brewing enzymes market

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the global brewing enzymes market. In addition, complete analysis of changes on the global brewing enzymes market expenditure, economic and international policies on supply and demand side. The report also studies the impact of pandemic on global economies, international trade, business investments, GDP and marketing strategies of key players present in the market. During COVID-19 pandemic, global brewing enzymes market was very heavily affected by massive supply chain distribution and strict lockdown protocols. Adding to that major issues like shutdown of bars, pubs etc. has resulted in declining availability of wine and beer products which has affected the market growth to a large extent. However, post COVID-19 the market has witnessed recovery for market at specific pace and is likely to have new growth opportunities stimulating the market growth.

Market Overview- Global Brewing enzymes market

Market Drivers

The global brewing enzymes market is driven by rapid production of brewing enzymes with increase in demand for different beer, wine type using microbial enzymatic sources. Besides, another essential factor for market growth is development of urban and sub-urban areas along with growing beer consumption has indeed supported the economic and income growth further creating the demand for market. Likewise, changing lifestyle of population and willingness to pay more for different varieties of beer has boosted the market demand to major extent. For example craft beer has observed major demand in the market which ultimately create a rise in requirement for brewing enzymes. All of these factors is expected to stimulate the market growth.

Market Opportunity

The growth of brewing enzymes market has been attributed with rising population demand for wine and flavored beer along with growing disposable income. Besides, gluten-free beers is currently emerging among the population with healthy lifestyle and this factor is anticipated to provide a new opportunity for production of brewing enzymes. Also, expansion of business from small to established manufactures have created new opportunities especially in the developing economies. Likewise technological expertise has expanded which has further led towards developing new fine-tuned research & development techniques for creation of larger facilities.

Market Restraints

The enzymes manufacturers essentially required to comply with the guidelines and regulations which are imposed by various existing governing agencies like the Food and Drug Administration (FDA), Association of Manufacturers & Formulators of Enzyme Products (AMFEP) and Enzyme Technical Association (ETA). It is expected that enzymes in the food industry are required to follow the guidelines which are defined by the Food Chemicals Codex agency as well. There is an absence of a uniform regulatory structure intended for the use of industrial enzymes, even though highly restrictive regulations are imposed for these industries in the, regions of Canada, UK and the European Union.

Market Growth Challenges

The major growth challenge emerged for the market was disruption of global supply chain due to COVID-19 pandemic which has resulted in rising cost brewing enzymes. Also, stringent regulatory standards for brewing enzymes has been major growth challenge for the market in the coming years.

Cumulative Growth Analysis

The report provides in-depth analysis of global brewing enzymes market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. With increasing demand for various brewing enzyme in various applications has led the increasing demand for market and is expected to witness the growth at a specific CAGR from 2021-2028.

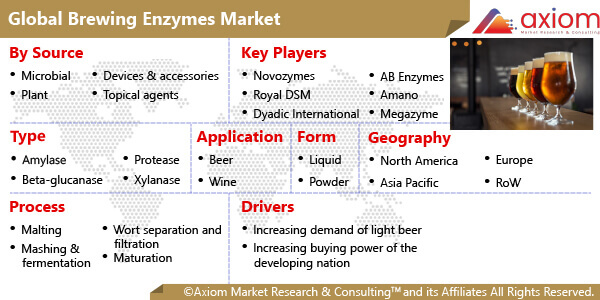

Market Segmental Overview

The global brewing enzymes market comprises of different market segments like source, type, application, form, process and geography.

Brewing enzymes Market by Source

By source, the enzymes include the microbial sources and plant-based sources. The microbial sources include the sources from Bacillus subtilis species whose example includes Bacillus licheniformis, and also the Aspergillus species like Aspergillus niger. Plant based source ideally include Wheat Kernel and Barley and are the most commonly present. The ease in availability is primarily factor which has boosted the demand for segment further its cost effective characteristic add an added advantage. In case of microbial sources, the positive factor propelling the demand is process of fermentation with microbial sources, it support for the improvement of storage capabilities. Due to this capabilities, the microbial sources explicitly show a process by which manufacturing is progressed at a faster rate which further is a major factor in extending the market growth.

Brewing enzymes Market by Type

The brewing enzymes market is characterized into different types like amylase, beta-glucanase, protease, xylanase, alpha acetolactate-decarboxylase, pectinase, hydrolase, beta-glucosidase, amyloglucosidase and others. The amylase shows a huge advantage like cost-effectiveness further consumes less time providing efficient process. Besides, another factors for the growth of segment is flourishing demand for production of beer. For instance Novozymes is one of the major company having increasing amylase enzyme production demand with growing beer consumption. Therefore, due to these key advantages, the amylase segment is expected to dominate the market.

Also, the use of commercial exogenous enzymes enhances the brewing process and improves its consistency. Rising demand for the presence of brewing enzymes in the beer segment is keenly expected to experience a glooming scale of growth in the upcoming future years, because of the rise in the popularity of beer consumption among the youth demographic. Factors like rise in technological advancements will enhance market growth in the number of microbreweries and general craft beer segment.

Brewing enzymes Market by Application

The brewing enzymes market finds its major application with respect to the products of wine and beer. Mostly it’s been manufacturer have demand brewing enzymes with microbial enzymatic sources due to their advantages of rapid large scale manufacturing capabilities. Beer is mostly been preferred by the young population due to range option present like gluten free beers and newly developed flavored beer as well as range of wine varieties. High quality yield production of beer due to amylase segment enzymatic use is also a beneficial reason for it being used in a large scale in most nations.

Brewing enzymes Market by Form

The brewing enzymes is present in two form including solid and liquid. The liquid form is preferred in the brewing process due to its advantages of saving energy, less water consumption, simplified whole filtering process and it reduces wastage of beer. The solid form process ideally required more time in filtration and also has increased wastage produced during the production.

Brewing enzymes Market by Process

The brewing enzymes are being produced by varied processes like malting, mashing & fermentation, wort separation and filtration and lastly the maturation. The raw material cost in case of malting may be optimized by using a commercial quality enzyme, as this is the widely used process used by most industries. This is also true in case of the wort separation process, wherein, it is preferred that the enzyme utilized is of commercial quality standard and a precise one. Newer technology has emboldened the productivity standard for both of these processes.

Brewing enzymes Market by Geography

The global Brewing enzymes market is studied for the following region North America, Europe, Asia-Pacific and Rest of the world (RoW). Asia Pacific is anticipated to lead in the brewing enzymes market during the forecast period (2022-2028). The region is likely to have growth due to various uplifting economic conditions. The main countries who are contributing excessively towards the growth of the market in the region includes the developing countries like China, Vietnam, New Zealand and Australia. Also the increasing manufacturing capability for different companies in Asia-Pacific region has as indeed gained increased consumption of beer and wine by the consumers which has driven the market growth. Along with this, Europe followed by North America are contributing healthy growth in the market during the estimated forecast period.

Competitive Landscape Analysis

The competitive landscape analysis of brewing enzymes market is majorly focused on expanding the global growth of brewing enzymes with new technological advancements, rise in demand for beer from the developing economic countries, at the same time availability for choice in various enzymatic alternatives for manufacturing beer and wine products has further relatively contributed great amount of healthy growth in the entire beverages market.

The key players studied in market are Novozymes, Royal DSM AB Enzymes, Amano, Dyadic International, Megazyme, Specialty Enzymes, Customized Brewing Solutions, Miller Coors, SAB Miller, Heineken N.V., Carlsberg Group, Diago Plc., Boston Beer Co., Associated British Foods PLC, Dupont Nutrition & Bioscience (IFF), A Group Soufflet Company, Caldic BV and others.

Recent Development:

November 2021: Amano Enzyme had recently introduced Umamizyme Pulse, a non-GMO enzyme which was designed for use in various plant protein products to produce a pleasant, savory umami flavor, similar to that provided by monosodium glutamate (MSG).

August 2020: Royal DSM had launched DelvoPlant, a wide range of enzymes for optimizing the taste, texture, and sweetness of plant-based drinks. Part of DSM’s expanding portfolio of solutions for dairy alternatives, these enzymes offered a varied range of benefits, which included the increase in the solubility of protein and reducing viscosity, unlocking the natural sweetness of raw materials like rice, oats and soy and also improving the mouth feel.