COVID-19 IMPACT ANALYSIS ON GLOBAL BATTERY SEPARATOR FILMS MARKET

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360-degree analysis of micro and macro-economic factors in the global Battery Separator Films market. In addition, complete analysis of changes in the global Battery Separator Films market expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The COVID-19 pandemic had a severe impact on the li-ion battery industry supply chain, including the battery separator films market. For example, the monthly sales of EVs in China declined by 39% in Q1 2020. The cost of lithium-ion batteries has dropped sharply over the past 10 years, such falling lithium-ion battery prices and the growing adoption of electric vehicles are the major factors drving the battery separators film market demand during the projection period.

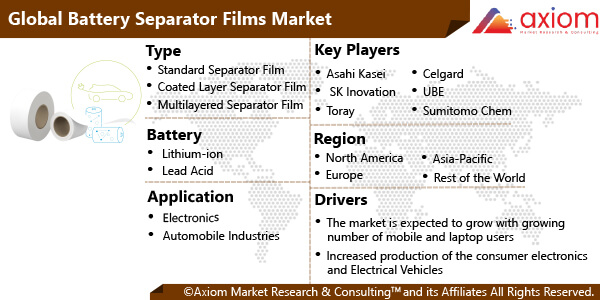

MARKET OVERVIEW- GLOBAL BATTERY SEPARATOR FILMS MARKET

Increasing demand for battery separator films in numerous industries including the automotive and consumer electronics industries will propel the market demand during the projection period. The growing penetration of electronics vehicles will further increase the demand for lithium-ion batteries, in turn, expanding the use of battery separator films. In addition, the growing adoption rate of micro-grids and wet process-based battery separator films in the automotive industry is also expected to propel the battery separator film market share throughout the forecast period. Furthermore, battery separator films are significant components in an electrical circuit. These films offer outstanding benefits such as chemical permeability, strength, resistance, and safety toward electronic short circuits. Battery separator films are also used in all types of electric vehicles including hybrid electric vehicles, plug-in electric vehicles, battery electric vehicles, and others.

MARKET DRIVERS

The global Battery Separator Films market is driven by the growing demand for electric vehicles. Electric vehicle sales have increased, with growth in all three top auto markets such as China, the US, and Europe. Reducing prices of EV batteries, increasing demand for electric vehicles in the transportation and automotive sectors, and government initiatives about EVs are major factors behind the growth of the market. Furthermore, a lithium-ion (Li-ion) battery, a rechargeable battery is widely used in electric vehicles and several portable electronics products. They have a higher energy density than typical nickel-cadmium or lead-acid rechargeable batteries.

MARKET OPPORTUNITIES

The market is expected to have a new opportunity with the advancements in battery production and design is expected to provide ample new growth opportunities in the market during the forecast period. Improvements in battery design and production as well as the emergence of next-generation manufacturing technologies are also expected to strengthen the sales in the global lithium-ion battery separator film market in the coming years. Advancements in Li-battery battery technology have considerably surged the demand for developments in battery separator film design.

MARKET RESTRAINTS

The market has major restraining factors like Safety Issues Related to Batteries. Safety issues related to usage, storage, and transportation of batteries are a major restraining factor that could hamper the market growth. Lithium-ion batteries (LIBs) with outstanding performance are extensively used in electric vehicles (EVs) and portable electronics, but frequent explosions and fires limit their more widespread applications. Lithium-ion battery fire hazards are related to the high energy densities together with the flammable organic electrolyte is the factor restraining the market growth.

MARKET GROWTH CHALLENGES

The large format cells hampered the growth of the market to a major extent which has created a major challenge for the market growth. Growing demand for large format cells that have more energy than usual small format cells is driving the need for the development of separators that have increased thermal stability compared to polyolefin materials. These larger format cells are being used in both power grid applications and electric vehicles and these batteries have a higher possibility to be a cause of thermal events like fire. These events can result in rapid large temperature increases and ultimately fires and even explosions.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the global Battery Separator Films market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. With the increasing demand for various Battery Separator Films in various applications has led to the increasing demand for the market and is expected to witness growth at a CAGR at specific CAGR from 2021-2028.

BATTERY SEPARATOR FILMS MARKET SEGMENTAL OVERVIEW

The global Battery Separator Films market comprises different market segments like type, battery, application and geography.

BATTERY SEPARATOR FILMS MARKET BY TYPE

By type, the Battery Separator Films includes a key segment of

- Standard Separator Film

- Coated Layer Separator Film

- Multilayered Separator Film

The standard separator film segment dominated the market in 2021 and is expected to maintain its dominance during the forecast period. The key factors boosting the growth of this segment include increasing demand for dry separators and wet separators from the automobile and electronics industry. Standard separator films are mostly used in the automobile industries and electronic device manufacturing companies. Therefore, the increasing use of dry separator films and wet separator films in applications such as high-performance lithium-ion batteries for consumer electronics, electric tools, and high-performance polymer batteries is attributed to the segment growth.

BATTERY SEPARATOR FILMS MARKET BY BATTERY

The Battery Separator Films market has a major battery in

The lithium-ion segment dominated the market in 2021 and is expected to maintain its dominance during the forecast period. The lithium-ion battery has a very high voltage and charges storage per unit mass and unit volume. A lithium-ion battery consists of many components. The key factors propelling the growth of the market are increasing usage and production of lithium-ion batteries, the constant development of smart devices and other industrial goods, decreasing prices of lithium-ion batteries, and an increasing number of R&D initiatives by manufacturers for improvements in Li-ion batteries. Likewise, the surge in the need for smartphones and other electronic devices and the growth of the electric vehicles market are some of the key factors that significantly drive the growth of the lithium-ion battery segment in the global battery separators film market. An increasing number of these electrical devices and vehicles has increased the demand for lithium-ion batteries which ultimately propels the market growth.

BATTERY SEPARATOR FILMS MARKET BY APPLICATION

The Battery Separator Films market has applications like

- Electronics

- Automobile Industries

The automobile industry is dominating the market for the battery separator film market. Increasing production and sales of electric vehicles across the globe are the major driving factor behind the market growth. Furthermore, the United States is among the countries leading in global EV sales, along with other economies like Canada, China, and Japan, which have already begun transforming their public transportation infrastructure to electric. However, automobile manufacturing plants produced and delivered very few automobiles owing to the global supply chain disruptions resulting from lockdowns. This can impact the growth of the battery separator films market during the pandemic period.

BATTERY SEPARATOR FILMS MARKET BY GEOGRAPHY

The global Battery Separator Films market is studied in the following region

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

The Asia Pacific is anticipated to witness increasing demand for Battery Separator Films owing to the presence of well-established market players. The Asia Pacific held the largest market share of the global battery separators films market for many years. The market here is anticipated to grow at a significant growth rate during the forecast period. Due to the strong presence of large battery manufacturers and several end-user industries in countries such as Japan, China, and India within this specific region, the Asia Pacific is expected to grow at a significant rate from 2022 to 2028. The Asia Pacific is expected to be the fastest-growing market for battery separator film during the forecast period. This region’s market expansion can be attributed to the high demand for battery materials in emerging markets such as China and India. This region has recently emerged as a hub for automobile production, opening up avenues and opportunities for the OEM market.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Battery Separator Films market is majorly focused on expanding the global growth of Battery Separator Films with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in Battery Separator Films has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfill the required demand of consumers which is further contributing to healthy growth in the market.

The key players studied in the market are

- Asahi-Kasei (Japan)

- SK Innovation (South Korea)

- Toray Group (Japan)

- W-scope Corporation (Japan)

- UBE Corporation (Japan)

- Entek (USA)

- Evonik ( Germany)

- Sumitomo chemical company, limited (Japan)

- Suzhou GreenPower New Energy Materials Co., (China)

- Senior Technology Material Co., (China)

- Celguard, LLC (USA)

- SEMCORP (China)

- Mitsubishi chemical corporation (Japan)

- Daramic LLC ( USA)

- Dreamweaver International (USA)

- Huiqiang New Energy (China)

RECENT DEVELOPMENT:

September 2021: Asahi Kasei announced that it will increase production capacity for the Hipore Li-ion battery (LIB) separator at its plant in Hyuga, Miyazaki, Japan. The increasing market for LIB is majorly propelled by automotive applications owing to the rising demand for electric-drive vehicles. Supplying both dry-process and wet-process separators with its Celgard and Hipore products, Asahi Kasei holds a world-leading position as a LIB separator producer.