COVID-19 IMPACT ANALYSIS ON EUROPE PLASTIC PAILS MARKET

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360-degree analysis of micro and macro-economic factors in the global Plastic Pails market. In addition, complete analysis of changes in the global Plastic Pails market expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The severe negative impact of the pandemic on the activity of many end-use industries in the plastic bucket market disrupted the demand for covered products in 2020. Corona virus has affected almost affected every industry on a global level, and these impacts are going to stay for a longer period of time. Due to COVID pandemic, various industries reduced their demand for plastic pails which includes paints and coatings, ink, dyes and pigments as well.

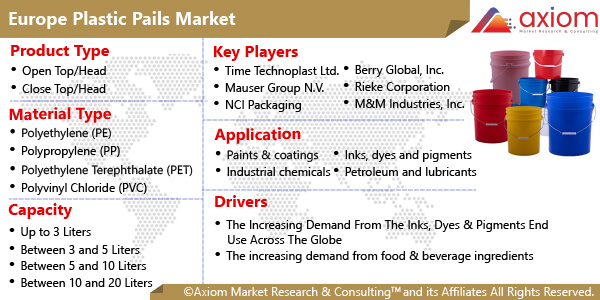

MARKET OVERVIEW- EUROPE PLASTIC PAILS MARKET

Plastic pails are widely known for their excellent stacking strength and have temper evident locking, making them ideal for industries where liquid products are widely preferred. Also, plastic pails are considered to be corrosion-free, rust-free, and have no contamination which plastic pails are highly preferred in the manufacturing industry. Moreover, in the last few years, as environmental awareness is increasing globally, many of the key market players are focusing on producing recyclable plastic pails which is likely to increase the market share of plastic pails across the globe. Additionally, demand for plastic pails has been widely demanded by the paints & coating, since this industry is growing at a rapid pace owing to the growth in the construction industry and plastic pails are considered to be airtight and do not leak liquid, which makes them suitable for paints and coating industry.

MARKET DRIVERS

The Europe Plastic Pails market is driven by growing consumer awareness of the harmful effects of plastic waste on the environment has shifted consumer preference towards recyclable packaging solutions. The manufacturer's sustainability goal is to reduce its carbon footprint and reduce damage to the environment. This provides recyclable plastic buckets and plastic buckets made from recycled plastic. Many manufacturers use post-consumer recycled raw materials to make their plastic buckets. This reduces your impact on the environment and attracts customers who prefer sustainable packaging solutions. Due to the growing reliance on recycled and recyclable plastic buckets, not only among consumers but also among manufacturers, the demand for plastic buckets in the global market is expected to increase.

MARKET OPPORTUNITIES

The market is expected to have a new opportunity with the increased demand for plastic pails from the food and beverage ingredients, lubricants, and chemicals sectors are expected to be the main driver of the global plastic bucket market. Globally, industrial chemical manufacturers tend to use inexpensive, lightweight yet durable packaging solutions for their bulk liquid packaging. Plastic buckets meet these requirements and thus find their first application in the industrial chemistry sector.

MARKET RESTRAINTS

The market has major restraining factors like the fluctuation in the prices of raw materials (polymers) for the production of plastic buckets is expected to be a major limiting factor for the growth of the global plastic bucket market. It is also subject to other market conditions.

MARKET GROWTH CHALLENGES

The Covid-19 pandemic hampered the growth of the market to a major extent which has created a major challenge for market growth. Also, a lack of a skilled workforce is expected to be a major hampering the market growth over the forecast period.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the Europe Plastic Pails market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. With the increasing demand for various Plastic Pails in various applications has led to the increasing demand for the market and is expected to witness growth at a CAGR at specific CAGR from 2021-2028.

EUROPE PLASTIC PAILS MARKET SEGMENTAL OVERVIEW

The Europe Plastic Pails market comprises different market segments like product type, material type, capacity, application and Country.

EUROPE PLASTIC PAILS MARKET BY PRODUCT TYPE

By type, the Plastic Pails includes a key segment of

- Open Top/Head

- Close Top/Head

With 4.22 percent of CAGR, the Open Top/Head plastic pails lead the market. Plastic pails are cylindrical plastic containers and are often used for storage and handling. The pail is a term used to refer to a cylindrical transport container. Usually, the capacity is from 3 to 50 liters. Plastic pails for industrial products, paints and coatings, food, and more, such as containers for storing large quantities of manufactured products. These are usually portable round containers used to transport or store small quantities of various materials. The transition from metal fabrication to plastic packaging solutions has completely changed the market landscape in the last two decades.

EUROPE PLASTIC PAILS MARKET BY MATERIAL TYPE

The Plastic Pails market has major material types in

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

With 4.57 percent, Polyethylene (PE) leads the market. Europe’s demand for polyethylene is expected to increase significantly due to the growing demand for packaging products and changing consumer lifestyles. In addition, the availability and low price of the PE are expected to contribute to market growth. However, environmental protection and consumer health awareness are expected to be major restrictions on the market. In addition, properties such as high hardness make polyethylene suitable for industrial use. It is mainly used for packaging cars and electrical spare parts.

EUROPE PLASTIC PAILS MARKET BY Capacity

The Plastic Pails market has a capacity like

- Up to 3 Liters

- Between 3 and 5 Liters

- Between 5 and 10 Liters

- Between 10 and 20 Liters

- Between 20 and 50 Liters

- 50 Liters and above

The major usage of plastic pails is between 10-20 liters and between 20 and 50 liters, These pails are used in food and beverage materials, industrial chemicals, detergents and polymers, resins, and, adhesives. The food ingredient market consists of the sale of food ingredients by entities (organizations, sole proprietors, and partnerships) that produce food ingredients that are added to food to improve taste, texture, and appearance. Food additives are substances added to food during production, storage, or packaging to achieve a specific technical or functional purpose. Food ingredients are used to improve the safety, freshness, and nutritional value of food.

EUROPE PLASTIC PAILS MARKET BY END USERS

The Plastic Pails market has major end users like

- Paints & coatings

- Industrial chemicals

- Inks, dyes, and pigments

- Petroleum and lubricants

- Cleaning solvents

- Polymers, resins & adhesives

- Food & beverage ingredients

- Agriculture & allied industry (fertilizers / pesticides)

Inks, dyes, pigments, petroleum and lubricants, and food & beverage ingredients are some of the major applications for this market. High-density polyethylene plastic pails are used in conjunction with other containers, such as barrels and trays for bulk packaging of adhesives and sealants. This product can extend the shelf life of paints by up to one year if properly sealed and stored. The 5-gallon product is one of the most popular HDPE pails for packing and storing adhesives and other liquids. The market for high-density plastic pails is driven by the growing demand from the paint packaging industry. The growing demand for plastic pails for food and beverages, lubricants, and chemicals is expected to be a major factor in the Europe plastic pails market.

EUROPE PLASTIC PAILS MARKET BY COUNTRY

The Europe Plastic Pails market is studied for the following region

- U.K.

- France

- Germany

- Italy

- France

- Spain

- Rest of Europe

Germany is anticipated to witness increasing demand for Plastic Pails owing to the presence of well-established market players. In the European region, Germany is the largest shareholder in the plastic bucket market. According to the Federation of the German Food and Beverage Industry (BVE), the German food and beverage industry was the fourth largest in 2019, with a total turnover of the food and beverage industry at the end of 2019 of 185, 3 billion euros (about 208 billion dollars). . 2019. The widespread use of plastic buckets in the food and beverage industry is expected to fuel the growth of the German plastic bucket market.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Plastic Pails market is majorly focused on expanding the Europe growth of Plastic Pails with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in Plastic Pails led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfill the required demand of consumers which is further contributing to healthy growth in the market.

The key players studied in the market are

- NCI Packaging

- Berry Europe, Inc.

- Alpla Group

- Amcor PLC

- Gerresheimer AG

- Plastipak Holdings, Inc.

- Graham Packaging Company LP

RECENT DEVELOPMENT:

June 2022: Berry’s Solution helps the Italian food manufacturing company Kata Food with different packaging shapes and fabulous artwork decoration, using the square SuperCube pails. The Kata company has previously used round pails for oil and pickle packaging. The company wanted to change the shape of their pack to something more attractive and practical. The SuperCube pails proved to be an ideal solution for new packaging.