COVID-19 IMPACT ANALYSIS ON THE NORTH AMERICA WATER TREATMENT CHEMICALS MARKET

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the global Water Treatment Chemicals Market. In addition, Due to lockdown across globe has halted the production of electronic parts, which retrains the growth of the water treatment chemicals market. In Addition, the supply of raw materials was disrupted due to regulations on the import & export of the chemicals and raw materials. Thus, the shortage in the raw materials resulted in the production of water treatment chemicals affecting the growth of the market. Moreover, shutting down off the production, manufacturing, oil & gas, and operations in the industries is anticipated to impact the growth of the water treatment chemicals market in 2020.

MARKET OVERVIEW- NORTH AMERICA WATER TREATMENT CHEMICALS MARKET

Water treatment chemicals are the components used for treatment of water. Different types of chemicals used for the water treatment process includes algaecides, antifoams, biocides, coagulants, etc. The three chemicals most commonly used as primary disinfectants are chlorine, chlorine dioxide and ozone. Monochloramine, usually referred to as chloramine, is used as a residual disinfectant for distribution. The global market is estimated and forecasted in terms of revenue (USD million) and value (KT) generated by the market from 2019 to 2024. Water treatment chemicals market shows a significant growth owing to increasing demand from various end user industries including food & beverage and metal & mining and increasing consumption of water across the globe. Rapid industrialization coupled with increasing population are the factors contributing to the growth of water treatment chemicals market. However, fluctuation in the prices of water treatment chemicals and easy availability of alternative methods for water treatment technologies are the prominent factors hindering the growth of the market.

MARKET DRIVERS

The NA Water Treatment Chemicals Market is driven by the stringent regulatory requirements to control the wastewater disposal from both municipal and industrial sources and increasing demand from the power industry in the United States. For instance, The United States Environmental Protection Agency (USEPA) emphasizes on the improvement of water and sewage services focusing in the municipal wastewater treatment area, and plans to invest an estimated capital investment of about USD 600 billion over the coming two decades. Hence, the use of targeted market is increasing due to a greater demand for purifying drinking water in the country.

MARKET OPPORTUNITIES

The region is shifting towards green chemicals which is likely to provide growth opportunities for the market studied during the forecast period. For instance, Electric power generators are the main source of water withdrawals in the US, accounting for over 40% of all withdrawals, according to the US Geological Survey. Significant levels of toxic metal impurities including lead, mercury, arsenic, chromium, and cadmium, are present in the wastewater discharged during the energy generation process. By 2050, the nation’s power production is projected to increase dramatically to 106.55 quadrillion British thermal units. This growth is expected to drive the demand for water treatment chemicals in the country during the forecast year.

MARKET RESTRAINTS

The market has major restraining factors like a rising popularity for chlorine alternatives for cooling water treatment. Moreover, the market for water treatment chemicals is being held back by alternative water treatment technologies as reverse osmosis (RO), ultrafiltration, and UV disinfection. Modern Technologies reduce the need for chemical water treatment. End Users are looking for sustainable options for water treatment as a result of growing environmental concerns and law. For instance, according to Environmental Protection Agency (EPA) encourages the use of UV disinfection over the chlorine-based biocides.

MARKET GROWTH CHALLENGES

The trend in the water treatment industry is moving away from chemical treatment and towards physical treatment technology such as membranes and UV disinfection which is a great challenge for the key players of the targeted market. Moreover, once the chemical, especially the specialty chemical, loses its patent protection and goes public, it becomes extremely susceptible to being copied which is also

cumulative growth Analysis

The report provides in-depth analysis of NA water treatment chemicals Market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. Rising demand for chemically treated water in various end-use industries has led the increasing demand for market and is expected to witness the growth at a CAGR at specific CAGR from 2021-2028.

North America

Water Treatment Chemicals Market Segmental Overview

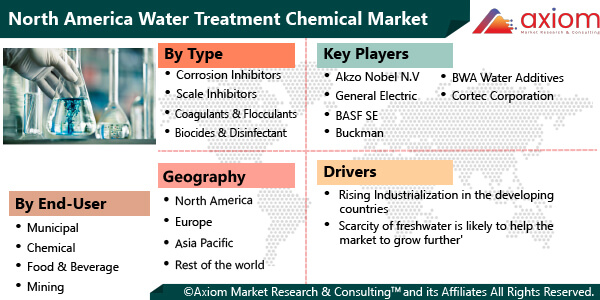

The Global North America Water Treatment Chemicals Market comprises of different market segment like type, end users and geography.

NORTH AMERICA WATER TREATMENT CHEMICALS MARKET BY TYPE

By type, the water treatment chemical market includes key segment of

- Corrosion Inhibitors

- Scale Inhibitors

- Coagulants & Flocculants

- Biocides & Disinfectant

- Chelating Agents

- Anti-Foaming Agents

- PH Adjusters & Stabilizers

- Others

Based on type, the water treatment chemicals market is segmented into corrosion inhibitors, scale inhibitors, coagulants & flocculants, biocides & disinfectant, chelating agents, anti-foaming agents, PH adjusters & stabilizers and others. Corrosion inhibitors are divided into anodic inhibitors and cathodic inhibitors. The scale inhibitors segment is further bifurcated into phosphonates, carboxylates/acrylic and others. Similarly, coagulants & flocculants are categorised into organic coagulant (polyamine and polydadmac), inorganic coagulant (Aluminum sulfate, Polyaluminum chloride, ferric chloride and others) and flocculants (anionic flocculants, cationic flocculants, non-ionic flocculants and amphoteric flocculants). The biocides & disinfectants further divided into oxidizing, non-oxidizing and disinfectants. The coagulants & flocculants segment is forecasted to grow at a higher pace and is projected to register for larger CAGR during the forecast period. The Largest share is primarily attributed to increasing demand for coagulants & flocculants from municipal waste water treatment process.

NORTH AMERICA WATER TREATMENT CHEMICALS MARKET BY END-USER

The WATER TREATMENT CHEMICALS MARKET has major end-user in

- Municipal

- Chemical

- Food & Beverage

- Mining

- Oil & Gas

- Pulp & Paper

- Others

The municipal segment leads the water treatment chemicals market in terms of value and is expected to maintain its dominance over the forecast period owing to extensive usage of the chemicals for industrial and municipal wastewater treatment applications. Rising water scarcity in the developed economies of Europe and North America has pushed the major players to focus on reusing and recycling water. Moreover, growing charge on waste treatment by the municipalities has further provided an impetus for the industrialist to maintain or improve their wastewater treatment and reuse facilities.

NORTH AMERICA WATER TREATMENT CHEMICALS MARKET BY COUNTRY

The NA Water Treatment Chemicals Market is studied for the following region

- United States

- Canada

- Mexico

The United States currently accounts to the highest share of the North America water treatment chemicals market due to highest consumers of water in the world. For instance, approximately 80% of the water and wastewater treatment industry is owned and managed publicly in the country. A resurgence in the manufacturing sector in the country is creating a demand for industrial water treatment, given the increasing need for water conservation and stringent environmental regulations. Hence, increased the need for water treatment operations, thereby driving the market for water treatment chemicals.

COMPETITIVE LANDSCAPE ANALYSIS

Most companies are primarily involved in mergers, acquisitions, and joint ventures in order to expand their product offerings and establish a significant presence in the market. New product launches and endorsements are the key growth strategies adopted by the major players to reinforce their positions in the international market. Furthermore, these companies are mostly involved in the manufacturing of sulphur and their by-products for use in various applications such as fertilizers, chemical manufacturing, petroleum refinery, and other related sectors.

The key players studied in the market are

- Kemira

- Ecolab

- Kurita Water Industries Ltd

- Solenis

- Suez

RECENT DEVELOPMENT:

July 2020: Solenis acquired Poliquímicos, S.A. de C.V. (Poliquímicos) headquartered in Mexico where Poliquímicos is a manufacturer and supplier of specialized chemical solutions for water-intensive industries.