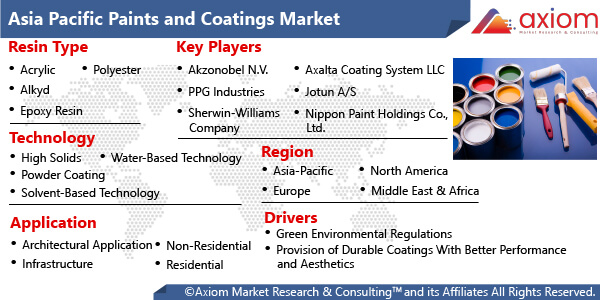

MARKET OVERVIEW- ASIA PACIFIC PAINTS AND COATINGS MARKET

Asia-Pacific is represented as the largest market for paints and coatings. It has a large and wide geographic presence and diverse population along with emerging economies are the main reason behind the Asia-Pacific growth. Rising demand for furniture coatings in China and increasing construction activity are driving market demand over the forecast period. The increasing construction activities in emerging economies such as China and India will also lead to market growth. The increasing demand for decorative coatings in houses, for greater aesthetics, is projected to push the demand for paints and coatings in architectural coatings in the next few years.

MARKET DRIVERS

The growing population and rising growth in urban housing, especially in China and India, are driving the growth of the Asia-Pacific Paints and coatings market. The growing investment in infrastructure, and the increasing demand for green and environmentally-friendly coatings. Additionally, in India Government initiatives taken such as ‘Smart City Mission’ and ‘Housing for All’ are projected to drive the growth in the construction sector which in turn results in demand for paints and coatings market. In India, the shift in consumer preferences from traditional whitewash to quality paints for indoor and outdoor applications will increase the demand for paints and coatings in the Indian market, which will indeed boost the demand for Asia-Pacific paints and coatings market.

MARKET OPPORTUNITIES

The Asia Pacific has evolved as a manufacturing hub over the past few years. Many global players are likely to invest in the Asia-Pacific region for its geographic presence, diverse population, and increased consumer spending due to emerging economies. The players also base their manufacturing footprint to serve customer demand, especially in the Asia Pacific region, owing to favourable policies, the availability of skilled labor at competitive remuneration, and stable raw material availability. Besides this, the paints and coatings market is also witnessing some advancements in technologies such as nanotechnology in coatings and many more. This factor will open up promising future opportunities in the Asia-Pacific over the forecast period.

MARKET RESTRAINTS

The increasing government rules over the use of paints and coatings. The regulations associated with the production of paints and coatings may hinder the market’s growth. Many companies are inclined toward low VOC content when manufacturing paints and coatings. These are some of the factors that affect market growth.

MARKET GROWTH CHALLENGES

Environmental regulations are likely to be the biggest challenge in the Asia-Pacific region’s economy and coatings market. In China, the government is profoundly serious about providing a cleaner environment for its citizens. The government of China has been imposing stringent rules regarding environmental regulations and compliance to combat air quality issues, which in turn results in a changing coating supplier base, as manufacturers decide whether to move plants or simply close them, which further impacts supply chain analysis.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the Asian Paints and Coatings market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. The increasing demand for various Paints and Coatings in various applications has led to the increasing demand for the market and is expected to witness growth at a CAGR at a specific CAGR from 2022-2028.

ASIA PACIFIC PAINTS AND COATINGS MARKET SEGMENTAL OVERVIEW

The Asia-Pacific Paints and Coatings market comprises different market segments like type, technology, end users and country.

ASIA PACIFIC PAINTS AND COATINGS MARKET BY TYPE

By type, Paints and Coatings include key segments of

- Alkyd Paints

- Vinyl Coatings

- Chlorinated Rubber Coatings

- Epoxy Coatings

- Polyurethanes

- Epoxy Mastic Coatings

- Others

The alkyd paints accounted for significant share in the market 2021 and is expected to maintain its dominance during the forecast period owing to its properties such as drying rate, adhesion, flexibility, and relative resistance, making it suitable for usage in paints and coatings. The increasing use of alkyd paints for architectural coatings of interior walls, windows, and panels. Thus, this is a major factor driving the growth of the segment over the forecast period. Epoxy coatings are also leading with an exponential growth rate over the forecast period owing to their major use in floor coatings, which is driving the segment growth in the coming period.

ASIA PACIFIC PAINTS AND COATINGS MARKET BY TECHNOLOGY

The Paints and Coatings market is segmented into technology such as

- Water-Based Technology

- Solvent-Based Technology

- High Solids

- Powder Coating

- Others

Based on technology, for the Paints and Coatings market, water-based technologies hold the major market share over the forecast period due to increased usage in automobiles, furniture, plastics, wood, and printing ink industries. Water-based technology is preferred over solvent-based because benefits such as no VOC emissions, quick drying, and easier application are some of the factors that drive the segment’s growth over the forecast span.

ASIA PACIFIC PAINTS AND COATINGS MARKET BY END-USERS

The Paints and Coatings market has major end users like

- Pharmaceutical

- Chemical

- Electronics

- Automotive

- Architectural

- Food & Beverages

- Packaging

- Others

The architectural segment holds the significant share market in 2021 and is expected to maintain its growth at a considerable growth rate. The increased use of paints and coatings in the architectural sector for building and construction of other warehouses, such as offices and residential building. In architectural applications, paints and coatings are mainly used for decorative purposes, for residential and non-residential buildings to protect them from UV rays and other environmental concerns. The increased use of these materials in the construction industry will drive the growth of the architectural segment in the coming years. The automotive segment is also leading at an exponential rate due to the demand for coatings and paints in the automotive sector to prevent automobile, cars, and bikes from corrosion, and other factors such as scratch resistance, flexibility, abrasion, and durability will boost the automotive industry’s growth over the mentioned time.

ASIA PACIFIC PAINTS AND COATINGS MARKET BY COUNTRY

The Asia Pacific Paints and Coatings market is studied for the following region

- China

- India

- Japan

- Rest of APAC (Malaysia, Thailand, Vietnam, Australia, South Korea, Singapore, etc.)

For years, China has dominated the market for paints and coatings. This growth is rising owing to the rising demand for paints and coatings from various industries. China is also the largest economy in terms of GDP. China is likely to become a manufacturing hub for the world. These evolving financial conditions lead to consumer spending due to the increased disposable income, which in turn results in boosting the demand for buildings and other infrastructural activities in the country. Further, the demand from commercial and residential sectors is expected to boost the paints and coatings market in China.

COVID-19 IMPACT ANALYSIS ON ASIA PACIFIC PAINTS AND COATINGS MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors in the Paints and Coatings market subjected to COVID-19. In addition, a market report studied the complete analysis of changes in the Paints and Coatings market expenditure and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The Asian paints and coating industry is impacted by the global economic downturn, which has been caused by an unexpected outburst of COVID-19. The upsurge in the COVID-19, pandemic situation has slightly weakened the demand for decorative paints & coatings in the year 2020 due to the lockdown and traveling. Although the Asia-Pacific has not witnessed a severe impact as compared to developed countries. The paints and coatings demand has witnessed a slowdown in sales due to construction activities such as the construction of facades, walls, and more have been stopped due to disruptions in supply chains that were caused by the traveling restrictions. In addition, lowered demand from a few major markets has put pressure on the paints and coatings market. Further, production and manufacturing have been affected by the closure of many plants in China which impacts other manufacturers who depend on raw material supply for the production of paints and goods.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Paints and Coatings market is majorly focused on expanding the growth of Paints and Coatings with new product innovation, business expansion, and the increasing presence of manufacturers operating in Paints and Coatings has led to the growing demand for the paints and coatings market. Besides, the market offers a range of products in different applications to fulfil the requirements of consumers, which is further contributing to healthy growth in the market.

The key players studied in the market are

- Sherwin-Williams Co

- Nippon Paint

- Asian Paints Ltd

- Dulux

- Dow Chemical International Private Limited

- Berger Paint

- BASF Coatings

- Kansai Paint

- Akzo Nobel N.V.

- PPG Industries Inc.

- Axalta Coating Systems

- Becker Group

- Jotun Group

- Henkel AG & Co. KGaAS

- Koninklijke DSM N.V.

RECENT DEVELOPMENT:

June 2022: Nippon Paint (India) Private Limited, Asia’s leading paint manufacturer, has announced the launch of AirCare VG and Sumo Xtra Dust Shield. The company’s Sumo Xtra Dust Shield with the color-lock technology formulated on water-based exterior emulsion keeps the walls bright and clean for years to come. AirCare VG is used for interior surfaces and is formulated with Silver Ion and Unique Absorption technology that helps to stay the indoor environment safer and hygienic

November 2021: The leading Indian company, Asian Paints Ltd., has announced that it will invest Rs 960 crore to expand the manufacturing capacity at Ankleshwar in Gujarat. The company has signed a memorandum of understanding with the Gujrat government. This expansion will include manufacturing capacity of paint from 1.3 lakh KL to 2.5 lakh KL and resins and emulsions from 32,000 MT to 85,000 MT.