MARKET OVERVIEW- EUROPE FATTY AMIDES MARKET

Fatty amides are fatty acids, for example oleamide, behenamide, erucamide, and stearamide, which are widely used across a variety of industries, such as plastic processing, rubber and ink. Almost 70 % of fatty amides are used in the film processing industry. Oleamide and stearamide are majorly used by industries such as paper, textiles, rubber, and ink. Fatty amides are being used as anti-blocking agents or slip agents in the polyolefin industry. Fatty amides provide a range of benefits and value-added properties. Fatty amides maintain the clarity of polyolefin film and act as an anti-blocking agent. Fatty amides and their derivatives are also used in emulsion polymerization and the manufacture of latex.

MARKET DRIVERS

Increasing application in end-user industries such as food & beverages, soaps & detergents and pharmaceutical & personal care provide several opportunities for the growth of the fatty amides market. The demand for packed food has been increasing owing to high purchasing power and busy life style will fuel the growth of the fatty amides market. Expanding the processed food and beverage industry mainly in the Europe region is expected to fuel the market growth of fatty amides. Also, increasing capital income per in developing countries and demand for personal care and cosmetic products is expected to fuel the market. Furthermore, the growing demand for plastic around the region due to the rising end-user industry is expected to fuel the market growth.

MARKET OPPURTUNITIES

Rising industrial spending is a key factor boosting the growth of the regional market. This region also encourages the entry of small and medium sized industries due to various factors such as the availability of cheap land and labor. The growing demand for slip additives from health care for offering better seal strength to the plastic packaging product is anticipated to foster market growth. Adding to that, the booming processed food industry is expected to create a lucrative opportunity for the market. Furthermore, the flourishing rubber industry around the globe is expected to offer potential growth opportunities for the market for fatty amides.

MARKET RESTRAINT

Europe is a developing region in the fatty amides market, such as the fluctuating price of raw material used for the production of fatty amides affecting the manufacturing process. Further, the high cost of production is increasing the cost of product. These factors are expected to hinder market growth. Moreover, countries like China are experiencing an economic downturn. These previously mentioned factors are projected to restrict the growth of the Europe fatty amides market.

MARKET GROWTH CHALLENGES

The Covid-19 pandemic hampered the growth of market to major extent which has created a major challenge for the market growth. The chemical and material sector has been noticing the adverse effects of the COVID-19 outbreak.

CUMULATIVE GROWTH ANALYSIS

The report provides in-depth analysis of Europe Fatty Amides market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. The growing launch of novel and innovative slip additive for seal packaging is expected to witness the growth at a CAGR at specific CAGR from 2022-2028.

EUROPE FATTY AMIDES MARKET SEGMENTAL OVERVIEW

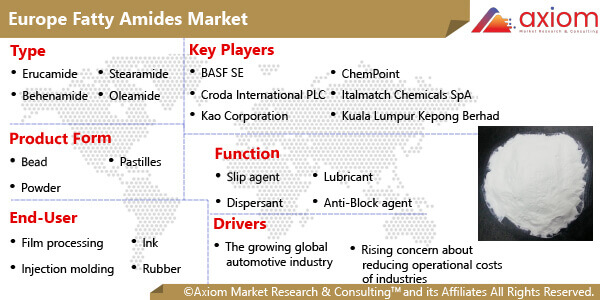

The Europe Fatty Amides market comprises of different market segment like type, product form, function, end-user and country.

EUROPE FATTY AMIDES MARKET BY TYPE

By type, the Europe Fatty Amides includes key segment of

- Erucamide

- Behenamide

- Stearamide

- Oleamide

The Erucamide segment is expected to dominate the market over the forecast period. Erucamide is manufactured by reacting purified erucic acid at elevated temperature and pressure with ammonia. The growing industrialization in the country and the booming food and beverage sector, along with rising demand for erucamide from the food and packaging industry are some major factors expected to drive the growth of the segment. Europe is growing in the erucamide market due to the booming textile industry.

EUROPE FATTY AMIDES MARKET BY PRODUCT FORM

By product form, the Europe Fatty Amides includes key segment of

The bead segment is anticipated to lead the market, gaining the majority of the market share in 2021, and is expected to maintain its dominance over the estimated time period. The bead is designed for use in most thermoplastics to impart improved properties such as lubricity, anti-blocking and mold release. Its demand from various end-user industries such as film processing, printing, ink manufacturing and others. Beads are mainly used in thermoplastics to improve their properties such as lubricity, anti-blocking and mold release.

EUROPE FATTY AMIDES MARKET BY FUNCTION

By function, the fatty amides include key segment of

- Slip Agent

- Dispersant

- Lubricant

- Anti-block Agent

- Release Agent

The slip Agent segment is expected to dominate the market over the forecast period. The slip additives are mainly used to reduce friction in polyolefin film while processing is a major factor boosting the demand for the segment. The growth in the packaging industry has resulted in the rise in the use of plastic resins across the region, thus fueling the scope of the slip additives.

EUROPE FATTY AMIDES MARKET BY END-USERS

By end-user, the fatty amides include key segment of

- Film Processing

- Injection Molding

- Ink

- Rubber

The film processing segment is anticipated to lead the market, gaining the majority of the market share in 2021, and is expected to maintain its dominance over the estimated time period. Stearamide and behenamide are used in combination with erucamide as an anti-blocking agent in polyolefin film processing. The growing food and beverages industry and the increasing consumer awareness regarding food safety and protection, there is increased demand for polyolefin film.

EUROPE FATTY AMIDES MARKET BY COUNTRY

The APAC fatty amide market is studied for the following Countries

- Germany

- France

- United Kingdom

- Italy

- Spain

- Rest of the Europe

Germany is anticipated to witness increasing demand for Fatty Amides owing to the presence of well -established market players. Germany remains the fastest growing major chemical market, but important changes are under way. Asian countries are known to be the fastest developing countries in the field of the chemical and material industry across the globe. Rising industrial spending is a key factor boosting the growth of the regional market.

COVID-19 Impact Analysis on Europe Fatty Amides Market

COVID-19 is an incomparable Europe public health emergency that has affected almost every industry, and the long-term effects are projected to impact industry growth during the forecast period. In addition, complete analysis of changes in the Europe Fatty Amides market expenditure, economic and international policies on the supply and demand side. The report also studies the impact of the pandemic on Europe economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. Furthermore, with the arrival of COVID-19, manufacturers in the rainwater harvesting market are increasing the production of systems that filter out bacteria and chlorine.

Competitive Landscape Analysis

The competitive landscape analysis of the fatty amides market is certainly based on the range of market players operating in the market, with an increasing demand for polyolefin films from food and beverage and packaging industries is expected to drive the market growth. Besides, a number of market players offer a wide range of products for different applications in various geographic locations. The market has major competitive analysis based on new product launches as well as other developments.

The key players studied in market are

- BASF SE

- Croda international PLC

- ChemPoint

- Itlmatch chemicals SpA

- Koa Corporation

- Kuala Lumpur Kepong Berhad

- Nippon Fine Chemical con., Ltd

- PMC Biogenix, Inc

- Pukhraj Additives

RECENT DEVELOPMENT:

January 2020: BASF closed the acquisition of Solvay’s polyamide thus, This will allow BASF company to support its customers with better engineering plastics solutions, e.g. e-mobility

June 2022: Italmatch Chemicals had acquired Aubin Group from BGF, investor of equity capital in the UK and Ireland. Aubin is an international key strategic developer and supplier of innovative chemical solutions for the oil and gas industries and renewable energies.