MARKET OVERVIEW- GLOBAL PACKAGE TESTING MARKET

Packaging testing encompasses different types of tests designed to examine the packaging materials for use with a given product. The test cases detect the characteristics of products. This includes packaging materials, packaging components, primary packages, shipping containers, unit loads, and other associated processes. Testing can be a qualitative or quantitative procedure. Testing can be performed by physical tests, chemical tests, or microbial tests. Packaging testing is a crucial part of the industrial packaging business. Packaging testing provides assurance for packaging that will protect against damage or degradation and contamination. Packaging testing can extend to the full life cycle. For some types of products, package testing is mandated by regulations this regulation is controlled by a variety of quality management systems such as HACCP, statistical process control, validation protocols, ISO 9000, etc. There are some risk factors involved in packaging testing, such as cost of packaging, cost of package testing, shipping cost, product liability exposure, and other potential costs. Packaging testing is kind of part of project management programs, and large companies have their own package testing and development laboratories, while many small companies and suppliers offer free packaging testing as services to customers. The increasing government rule about food safety and growing consumer awareness is the leading cause of market growth.

MARKET DRIVERS

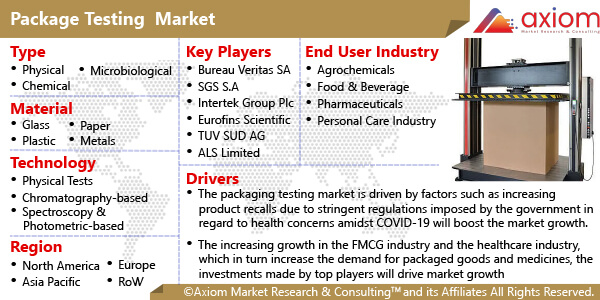

The packaging testing market is driven by factors such as increasing product recalls due to stringent regulations imposed by the government in regard to health concerns amidst COVID-19, an increasing need for durable products, increased demand for packaged products due to the growth of the FMCG industry, and increasing awareness about materials that will be used in the packaging process, which will also be driving the market growth in coming forecast time. The increasing use of food packaging and health packaging in respected industries is also playing a major role in market growth. The influencing factors such as the implementation of new standards and relations, increasing demand for innovative packaging technology, ever growing e-commerce industry and rapid urbanization are also likely to drive the market in coming years. The packaging testing market is also driven by the development of advances in packaging testing, such as simple testing and rigorous testing, which have led a positive impact on the market growth. Furthermore, increasing growth in the FMCG industry and the healthcare industry, which in turn increase the demand for packaged goods and medicines, the investments made by top players and laboratory establishments are playing a major role in the packaging and testing market.

MARKET OPPORTUNITIES

The global Packaging Testing Market is expected to witness increasing new growth opportunities for the market with development in the transport packaging industry, food packaging industry. The continuously changing standards of the evolving packaging industry provide opportunities in the coming future. There is a continued demand for evaluating the materials utilized in packaging. The development of smart packaging also brings new opportunities in the market along with the ongoing development of different test cases by leading players in the industry, which brings more options in the market. Sensory testing and consumer studies can help identify the characteristics of the packaging that customers like and dislike, providing key insights into what affects a consumer’s buying decision.

MARKET RESTRAINTS

The major restraining factor for the global Packaging Testing market is cost of packaging testing materials. According to the Industrial Physics Sustainable Packaging Research report there are 69% of packaging professionals found cost as the biggest barrier. The cost of equipment also impacts the further aspects in the supply chain and transport industries, which is the main obstacle in the packaging testing market. There is a lack of material testing for all new packaging materials, preventing the market’s growth.

MARKET GROWTH CHALLENGES

The packaging testing industry is facing challenges such as optimizing material performance to protect goods, passing increased material costs onto the consumer, and the ability to meet safety and testing standards. To optimizing the quality control processes are also an issue in packaging testing, matching with the new standards and new legislation/regulatory requirements also represents the major challenge. Due to the increasing demand for convenience, packaging should be easy to handle, easy to open, and resalable. Packaging comes in various forms and materials, thus requiring specially adapted, flexible fixtures for the many testing solutions.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the global Packaging Testing Market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. The increasing demand for smart packaging and rising health concerns among consumers and development in the FMCG industry led to the market growing at exponential growth in coming years.

PACKAGE TESTING MARKET SEGMENTAL OVERVIEW

The global Packaging Testing Market comprises different market segments like type, material, technology, end-user industry, and geography.

PACKAGE TESTING MARKET BY TYPE

By type, the packaging testing includes a key segment of

- Physical

- Chemical

- Microbiological

Physical testing is likely to gain a significant share in the market, due to its importance in the determination of the physical properties of a product and is an essential application for packaging testing. This segment is followed by chemical testing of packaging, which is essential for the determination of chemical properties such as corrosion level and overall composition of the material, monitoring product quality, toxic detection, contaminant detection, and meeting other regulatory standards.

PACKAGE TESTING MARKET BY MATERIAL

The Package Testing market is segmented into the following materials:

Based on material, for the Package Testing market, plastic material accounted for a major market share. This is attributed to plastic being widely used in the global packaging industry due to its high performance, low, cost, and ease of customization as per requirements. Plastic packaging also acts as an excellent barrier to water, oxygen, and carbon dioxide; it is also lightweight and resistant to chemicals and heat. These factors boost plastic material demand in plastic packaging testing solutions during the forecast time.

PACKAGE TESTING MARKET BY TECHNOLOGY

Based on technology, the packaging testing market is divided into

- Physical Tests

- Spectroscopy & Photometric-based

- Chromatography-based

The physical test is projected to gain a major market share during the forecast time. Physical testing assures the reliability, quality, and performance of packaging products. It is also helpful in improving the efficiency of product performance, which will result in cost savings.

PACKAGE TESTING MARKET BY END-USER INDUSTRY

The Package Testing market has major end users like

- Agrochemicals

- Food & Beverage

- Pharmaceuticals

- Personal Care Industry

- Automobile

- Transportation

- Environmental

- Others

The Food & Beverage segment will grow at the highest CAGR during the forecast period due to increasing consumer awareness regarding food safety. In addition, the government regulates labeling and packaging opening growth opportunities in the packaging and testing market. The pharmaceuticals segment holds an important share in the market, and it is expected to grow at a rapid pace during the forecast, along with food and beverage segment. It is attributed to the increasing health concerns amidst COVID-19. Whereas, the transportation segment will also grow at a significant CAGR in the forecast span.

PACKAGING TESTING MARKET BY GEOGRAPHY

The global packaging testing market is studied for the following region

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

The North American region is expected to hold an important position in the market, and likely to grow at significant rate. Since, demand for packaging testing in the U.S. is booming due to the establishment of the Food and Drug Administration and strict regulatory policies and approvals issued by them, as well as the rise in consumer expenditure on pharmaceutical drugs and medicines in the country. According to the report of Economic Co-operation and Development (OECD) in 2019 it has been stated that in the U.S. pharmaceutical spending per capita in the U.S. was US $ 1376.27 which was the highest in the world at that time. The rising geriatric population and suffering from chronic diseases are contributing to the market growth in the region. Moreover, Asia-Pacific is also considered to hold an important position in the market owing to rising demand for packaging and testing across food and beverage, electronics, pharmaceuticals, and other various industries in the region.

COVID-19 IMPACT ANALYSIS ON GLOBAL PACKAGE TESTING MARKET

The exclusive COVID-19 impact analysis report by Axiom MRC provides a 3600 analysis of micro and macroeconomic factors in the global Packaging Testing Market. In addition, a complete analysis of changes in the global Packaging Testing Market expenditure, economic, and international policies on the supply and demand side is represented. The report also studies the impact of the pandemic on global economies, international trade, business investments, GDP, and marketing strategies of key players present in the market. The food & beverage companies have developed response actions and effective plans to help mitigate their risk and prepare for how they would deal with the effects of coronavirus. These plans have established an interdisciplinary crisis response team of people from all aspects of the business to identify, assess, and manage the risk presented. In COVID-19 people became more concerned about their health and these factors are driving nutritional packaged food demand in COVID-19. Furthermore, due to lockdown shutting down of various plants, factories, and sites, resulted in low production and sales and lower usage of packaging. In addition, demand and supply were also affected by the COVID-19 pandemic, which disrupted supply chain activities. The top and leading companies also experienced a slow-down in their revenue that resulted in a lack of utilization of the equipment. In COVID-19 consumer packaging demand is drastically inclined toward food and the packaging industry due to the shutting down of restaurants and food services. Moreover, the demand for healthcare packaging is also increasing and will rise across different healthcare-packaging types and related substrates, including flexible blister foils, pumps, closures, and rigid plastics. Similarly, demand will rise for packaging used in dietary supplements, such as vitamins, and for essential supplies, such as allergy medication, that consumers will need in a lockdown situation. These are all factors contributing to the packaging testing market’s growth amidst the coronavirus outbreak.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the Packaging Testing Market certainly includes the top operating players with increasing demand for the production of packaging testing equipment. Besides, a number of market players offered wide a range of products for different applications in various geographic locations. The market has a major competitive analysis based on new product launches as well as other developments.

The key players studied in the market are

- Bureau Veritas SA. (France),

- SGS S.A. (Switzerland),

- Intertek Group Plc (United Kingdom),

- Eurofins Scientific SE (Luxembourg),

- TUV SUD AG (Germany),

- ALS Limited (Australia),

- Merieux NutriSciences Corporation (France),

- National Technical Systems, Inc. (United States),

- Microbac Laboratories, Inc., Ltd. (United States),

- EMSL Analytical Inc. (United States),

- Campden BRI (United Kingdom),

- ifp Institute for Product Quality GmbH (Germany),

- MET Laboratories, Inc. (United States),

- Mesa Labs (United States),

- Micom Laboratories Inc (Canada),

- North American Testing Services (United States),

- Smithers (United Kingdom),

- UL Solutions (United States)

RECENT DEVELOPMENT:

July 2022: The India-based company PACORR Testing Instruments has launched a massively updated testing machine that is the Box Compression Tester. This testing machine will help manufacturers in the paper and packaging industries evaluate the quality of packaging or corrugated boxes. This testing machine will easily calculate the amount of vertical compressive force a cardboard box can take before deforming or collapsing. This machine is designed in line with international standards like ASTM D642 and ASTM D4169.

June 2022: UL’s certified International Safe Transit Association (ISTA) lab can perform packaging tests to assess the security of goods during transport. To increase demand for transport services, especially in e-commerce, the UL’s laboratory in Singapore has added several ISTA testing protocols to its services. These protocols include Procedure 1A for packaged products weighing 150 lb (68 kg) or less, procedure 1B for packaged-products weighing over 150 lb (68 kg), Procedure 1C Extended Testing for Individual Packaged-Products weighing 150 lb (68 kg) or less, and more.

July 2022: UL LLC has been approved by the World Health Organization (WHO) for testing vaccine storage refrigeration devices to the WHO PQS E003 series of standards. This standard is used to evaluate for refrigeration equipment. The performance requirements focus on criteria to safely store vaccines at specific temperatures for long periods of time.

April 2022: Smithers, a leading provider of packaging testing, consulting, information, and compliance services, has announced the investment in an Agilent 8890 GC/5977B MSD for cannabis testing. This state-of-the-art system enables Smithers to refine and expand its terpene analysis. In addition to superior resolution for terpene profiling, its automation and configurability reduce the time spent on sample analysis and allow Smithers to explore the latest developments in cannabis testing.

May 2022: Intertek, the world’s leading company in testing and quality assurance, is pleased to announce the expansion of its 5G assurance, testing, and certification services for East Asian clients. Intertek- Taiwan has been approved by U.S. wireless communications industry association CTIA as a PCS Type Certification Review Board (‘PTCRB’) Associate Test Laboratory with a scope covering requirements for 5G FR1 RF, RRM, Performance, and Protocol.

April 2022: The International testing, inspection, and Certification Company TUV SUD and ioMosaic, a leading U.S. provider of process safety solutions have mutually agreed to the formation of a strategic alliance in risk management and process safety services. The transaction will benefit the customers of both companies, delivering them a wider range of services plus additional digital applications.

Dec 2021: TUV SUD, a testing and certifying company, has announced the launch of a new lab facility for testing and certifying electrical and electronic products and medical devices in Bengaluru. This new lab facility will be completed by 2023. This project is projected to cost an estimated €15 million. The facility is warehoused on 3 acres and comprises 70,000 sq. and is located in Bengaluru.

December 2020: Packaging Technologies & Inspection, is a global leader in package testing equipment, has announced the completion of its acquisition of Leak Detection Associates (LDA), the leader in helium-based, high-sensitivity leak detection systems for the pharmaceutical and biologic industries. LDA’s leak detection solutions are widely known as a market leader for both cold chain and parenteral container applications, and this partnership will benefit both companies.