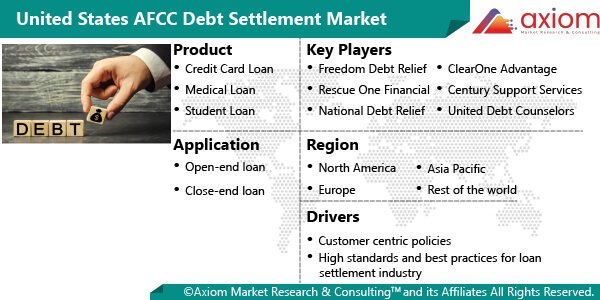

MARKET OVERVIEW - UNITED STATES AFCC DEBT SETTLEMENT MARKET

The AFCC defends consumer rights on behalf of Americans who are struggling financially and have unsustainable unsecured debt loads. An agreement between a creditor and a debtor known as AFCC debt settlement enables the debtor to repay a debt over time. It is a third-party business that provide AFCC debt settlement service that might attempt to lower their customer’s debt by negotiating settlement with their creditors or debt collectors. The American Fair Credit Council establishes, promotes, and upholds high standards and best practices for the debt settlement sector. The debt settlement is done for medical loans, student loans, and credit card loans and among others.

MARKET DRIVER

AFCC Debt Settlement has customer-centric policies. This helps the market to grow in the forecast period. There have been reports of consumers procuring debt settlement solutions and services after experiencing financial hardships due to life events like job loss, chronic illness, or divorce. Such challenges often limit available and disposable cash flow required to pay or service minimum payments, thus making consumers incapable, rather than unwilling, to pay off debts. Though financial hardships stemming from unfortunate and unexpected life events are not contained in a solo income level, consumers in lower-to-middle income levels, and ones who lack collateral are susceptible to dealing with severe debts and are the most in need of debt relief provided by debt settlement solutions and services. Customer centric policies helps this kind of customers in their bad time.

MARKET OPPORTUNITY

High standards and best practices for loan settlement industry creates the growth opportunity for the market. If the lender is convinced that your reason for non-payment is genuine, he may consider offering a 6-month non-repayment period. This type of practice helps the market grow.

MARKET RESTRAINT

Factors such as the increase in credit card fraud across the globe are expected to hamper the AFCC debt settlement market growth. On the contrary, technological advancements in product offerings like using block chain for increased security are expected to offer remunerative opportunities for the expansion of the market during the forecast period.

MARKET GROWTH CHALLENGES

Consumers able to fulfil debts may not find debt settlement solutions and services to be that lucrative. Therefore, debt settlement solution providers tend to carefully screen prospects seeking to participate in debt settlement programs.

CUMULATIVE GROWTH ANALYSIS

The report provides in-depth analysis of the United States AFCC debt settlement market, including market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. The rising awareness about the benefits of debt settlement has led to the increasing demand for the market and is expected to witness growth at a CAGR at specific CAGR from 2021-2028.

UNITED STATES AFCC DEBT SETTLEMENT MARKET SEGMENTAL OVERVIEW

The United States AFCC debt settlement market comprises of different market segments like, product, application, and geography.

UNITED STATES AFCC DEBT SETTLEMENT MARKET BY PRODUCT

By product, the AFCC debt settlement includes a key segment of:

- Credit Card Loan

- Medical Loan

- Student Loan

- Others

Credit card loans are expected to dominate the market over the forecast period. Credit-card debt: a business or person pays off their credit card obligations through the AFCC debt settlement process by negotiating with the credit card issuers. The segment’s growth is owing to the fact that there were 537 million credit card accounts in the United States in quarter 1, 2022. Out of these total credit card accounts, credit debt totals around $ 841 billion. In the United States, Laska has the highest average credit card debt at $6,617 per person. The credit card loan settlement procedure aims to lower the amount of interest that must be paid on the remaining balance and enhance the loan’s condition. Similarly, the medical loan segment is expected to be the fastest growing in the AFCC debt settlement market. For instance, 100 million adults have health-care debt, and almost 12 % of them owe $10,000 or more.

UNITED STATES AFCC DEBT SETTLEMENT MARKET BY APPLICATION

By application, the AFCC debt settlement includes key segment of

- Open-End loan

- Close-End Loan

The open-end loan is anticipated to lead the market, gaining the majority of the market share in 2021, and is expected to maintain its dominance over the estimated time period. There were 365 million open credit account in the United States as of the end of 2020, according to the released in May 2021 by the American Banker Association. Open-end loan is a loan that does not have a definite end-date. Line of credit and credit cards are two examples of open-ended loans.

COVID-19 IMPACT ANALYSIS ON UNITED STATES AFCC DEBT SETTLEMENT MARKET

The AFCC develops a crisis budget to help during economic impact of COVID-19. This includes Revamp the household budget, stop payments to long-term financial objectives, pause automatic savings withdrawals, audit all automated subscriptions, move all monthly bills to minimum payments, lower household expenses, look for ways to reduce utility bills, save money on food costs, save money on food costs, and contact creditors for assistance. The American Fair Credit Council (AFCC) has launched a COVID-19 resource center to assist consumers impacted by the recent nationwide response to the coronavirus pandemic. Consumers may now search for helpful resources and links to state and federal programs related to unemployment insurance, replacing health insurance coverage lost to termination, and locate state and federal financial assistance for workers and small businesses impacted by the social distancing mitigation response.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the AFCC debt settlement market is majorly focused on expanding the growth of AFCC debt settlement with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in AFCC debt settlement has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfill the required demand of consumer which is further contributing to healthy growth in the market.

The key players studied in market are

- Freedom Debt Relief

- Rescue One Financial

- National Debt Relief

- ClearOne Advantage

- Century Support Services

- United Debt Counselors

- New Leaf Financial

- Countrywide Debt Relief

- Liberty Debt Relief

- Debt RX

- Pacific Debt

- Pacific Debt

- New Era Debt Solutions

Recent Development:

October 2021: The company rebranded its name from Pacific Debt Inc. to Pacific Debt Relief, which would allow Pacific Debt to remain loyal to its roots in debt settlement.

August 2018: With hyper growth of the company in recent years, the company announced plans to grow from 265 employees to 300 employees, also renovated and remodeled its 34,000 square foot space in the Banco Industrial Park.

June 2020: The company launched two initiatives to reduce the student burden, which include a student loan forgiveness initiative for its clients and a $50,000 scholarship program.