MARKET OVERVIEW- GLOBAL FOOD INCLUSIONS MARKET

Food inclusions are ingredients added to foods to improve their texture or organoleptic properties. Food inclusions can also improve the sensory qualities of food products. Food inclusions are additional food ingredients that add value to food. Food inclusions are becoming increasingly popular as they can impart any desired flavor and texture, thereby increasing the appeal of food products. Food inclusions, which help give products health benefits, are becoming increasingly popular. Additionally, food inclusions find wide applications in dairy and frozen desserts, baked goods, breakfast cereals, chocolate and confectionery products, and many more. The market growth can mainly be attributed to the high demand for packaged foods such as cakes, breads, chocolates, jellies and frozen desserts, which are expected to expand the food integration market in the region. Additionally, changing dietary habits and increasing consumer disposable income are other factors that will pave the way and provide ample new growth opportunities for the market over the estimated time period.

MARKET DRIVERS

The food and beverage industry is experimenting with several innovations as customer taste profiles change. Consumers are willing to try new and captivating products with variations in flavor and other characteristics, leading food and beverage manufacturers to develop products with unique flavors. For example, strawberries, raspberries, and cherries are some of the most common fruits used by chocolate makers, but now chocolate makers also use peach in their products. Similarly, hazelnuts, almonds and peanuts are quite popular when it comes to nuts, but now chocolate makers also use pistachio, flaxseed and sunflower seeds in their chocolate products. Herbs and spices, such as chocolate infused with ginger, chilli, and cinnamon, are also gaining in importance for their health benefits. According to Ingredion data, about 42% of consumers require less sugar in baked goods for better health benefits. As a result, a large percentage of food and beverage manufacturers are now increasingly consumer-oriented with their product development and R&D programs are broadly aligned with consumer demands, providing the manufacturers operating in the industry with significant opportunities to develop new products in the field of food inclusion.

MARKET OPPORTUNITIES

In recent years, the inclination towards convenience foods has increased significantly due to changing demographic dynamics, such as increasing disposable income, population growth, increasing urbanization and an increasing proportion of working women. In addition, industrial nations are also experiencing a continuous increase in the proportion of employed women. According to Harvard Business Review, the participation of women in the United States has almost doubled in recent years, which has increased the demand for ready meals even in developed countries, which is expected to support the growth of the Food Inclusions market. Besides, emerging features and flavors have gained major attention from consumers across the world, and this factor is expected to provide new growth opportunities for the market over the forecast period.

MARKET RESTRAINTS

Food inclusions are generally used in various applications to improve the taste and nutritional values of products, which leads to higher cost and directly affects the final price of finished products. The high cost of food inclusions can be largely attributed to their high raw material costs and the increasing application of inclusions in food and beverage products. Moreover, as the taste profile of the consumer is improvised, there is a need for unique products. The requirement of unique products can be satisfied by modifying local products or by imported products, which in turn leads to a higher price for the final products. In addition, the ingredients used in the production of food inclusions for bakery, confectionery and ready meals are subject to strict health and safety controls based on the government regulations of each country, thus affecting the growth of the market during the forecast period.

MARKET GROWTH CHALLENGES

Adding inclusions to food products poses a major challenge for food and beverage manufacturers due to the conditions required for storage and based on their properties. Furthermore, determining which step in the manufacturing process to add to the final product to extend the shelf life of the products is also one of the challenges for food and beverage manufacturers. As the consumer’s desire to consume new and unique flavors further hinders the growth of food inclusions, unique inclusions have to be imported from different geographic areas which are traditional products. All of these factors are expected to challenge the growth of the market during the forecast period.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the global Food Inclusions market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. With increasing demand for food inclusions in various applications has led the increasing demand for market and is expected to witness the growth at a specific CAGR from 2022-2029.

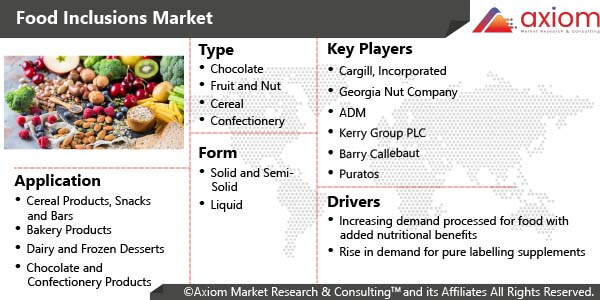

FOOD INCLUSIONS MARKET SEGMENTAL OVERVIEW

The global Food Inclusions market comprises of different market segment like type, form, application and geography.

FOOD INCLUSIONS MARKET BY TYPE

By type, the Food Inclusions market includes the key segments of

- Chocolate

- Fruit and Nut

- Cereal

- Flavored Sugar and Caramel

- Confectionery

- Others

The chocolate segment is expected to dominate the market during the forecast period. Chocolate inclusions include chocolate shavings and chunks, granella, crunchy bites, chocolate flakes, chocolate pastes and chocolate shavings, which can add a splash of color, mild or strong flavor and textures unique to confectionery, baked goods and pastries, ice cream and dairy products. Furthermore, continuous rise in demand for chocolate flavored food products among consumers irrespective of their age and gender is a major factor driving the included chocolate segment market.

The fruit and nut segment is expected to register a high CAGR during the forecast period. The dried nuts and fruits can improve health and prevent some diseases if they are regularly included in the diet. Due to their interesting nutritional profile, some studies have evaluated the impact of nuts on health and observed an inverse association between the frequency of nut consumption and cardiovascular disease (CVD), type 2 diabetes and body weight. Additionally, nuts also provide essential nutrients, such as fiber and potassium, and a wide variety of phytochemicals linked to health promotion and antioxidant capacity. Both nuts and dried fruit can be eaten as a snack, in addition to breakfast cereals, yogurt, salads and pasta, and can provides a number of important health benefits.

FOOD INCLUSIONS MARKET BY FORM

On the basis of form, the Food Inclusions market is segmented into

- Solid and Semi-Solid

- Liquid

The solid and semi-solid segment is expected to register the highest CAGR during the forecast period. Solid and semi-solid food inclusions include pieces, nuts, flakes and crunches, chips and nibs and powder. Solid nuts are extremely popular with customers and are widely used in baked goods, confectionery, dairy and frozen desserts, snacks and bars, cereals and beverages. Solid form inclusions can add crispiness or an attractive texture to food preparation.

The liquid segments are anticipated to be the fastest growing segment over the forecast period. The liquid form is used according to the needs of applications such as cakes, ice cream, yogurt, chocolates, pastry and beverages. Furthermore, the ingredients used in the production of the food inclusions play an important role in the final form. For example, chocolate syrups and fruit syrups determine a certain relationship in the formation of a solid form of food inclusion suitable for use in the preparation of confectionery and bakery products.

FOOD INCLUSIONS MARKET BY APPLICATION

The Food Inclusions market has key applications in

- Cereal Products, Snacks and Bars

- Bakery Products

- Dairy and Frozen Desserts

- Chocolate and Confectionery Products

- Others

The bakery products segment is expected to record the highest CAGR during the forecast period. Baked goods include cookies, bagels, sandwiches, sandwiches, pastries, cakes, cookies, muffins, pizza, brownies, etc. Food inclusions are widely used in baked goods for garnishing, flavouring, decorating and other purposes. Food inclusions come in slices, flakes, nuggets, and pellets, among others. Food inclusions are available throughout the year, are affordable, and retain flavors and nutrients, further increasing the demand for food inclusions.

The dairy and frozen desserts segment is expected to witness high growth over the projected time period. Dairy products and frozen desserts include yogurts, creams, sour cream, puddings, ice creams, kefir and sorbet. Chocolate fillings are mainly used in dairy products. Fruit and berry fillings are often used to make kefir, yogurts, creams, desserts, puddings and other dairy products. Dairy products have traditionally been recognized worldwide as products with many health benefits, so food inclusions are also becoming more popular, and it also provides a different textures and flavors.

FOOD INCLUSIONS MARKET BY GEOGRAPHY

The global Food Inclusions market is studied for the following region

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

North America is expected to dominate the Food Inclusions market over the forecast period due to the presence of major processed food producers in the region and changing consumer preferences for food of variety and attractiveness in countries like the United States and Canada. The increasing use of food inclusions in various products to improve quality, taste and texture should lead to a significant market share in the European market in the coming years.

However, the Asia-Pacific market is expected to record the highest CAGR over the forecast period due to economic growth in the region, resulting in an increase in per capita disposable income, boosting sales of various processed foods.

COVID-19 IMPACT ANALYSIS ON GLOBAL FOOD INCLUSIONS MARKET

Axiom MRC provides a 360 degree analysis of micro and macro-economic factors on the global Food Inclusions market. In addition, complete analysis of changes on the global Food Inclusions market expenditure, economic and international policies on supply and demand side is provided in this exclusive report. The report also studies the impact of the pandemic on global economies, international trade, business investments, GDP and marketing strategies of key players present in the market.

The COVID-19 outbreak is negatively impacting the economies and industries of several countries due to lockdowns, travel bans and business closures. The Food Inclusions market has had a strong impact on product trends. The pandemic has prompted consumers to choose healthy food products with different functional properties. To break the routine imposed by the lockdown, consumers' desire for new and innovative products to experience different culinary adventures also influences market trends for food inclusions. The demand for fruits and nuts is expected to increase in the coming years due to the health benefits they provide. Travel restrictions affected food and drink taste trends as people were not able to travel and experience the exotic flavors of different regions and countries. For example, Asian-inspired food inclusions like mocha and taro are seeing growing consumer demand. Although the COVID-19 pandemic has had a negative impact on the production and supply of food inclusions, it has had a positive impact on product trends in the market.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of Food Inclusions market is majorly focused on expanding the global growth of food inclusions industry with new product innovation, business expansion, increasing presence of range of manufacturers operating in food inclusions sector has led the growing demand for the market. Besides, the market offers range of products in different application to fulfil the required demand of consumer which is further contributing to healthy growth in the market.

The key players studied in market are

- Cargill, Incorporated

- Georgia Nut Company

- ADM

- Kerry Group PLC

- Barry Callebaut

- Sensient Technologies Corporation

- Puratos

- Balchem Inc.

- Orkla

- Tate and Lyle

- AGRANA Beteiligungs-AG

- Nimbus Foods Ltd.

- FoodFlo International

- Orchard Valley Foods Limited

- Taura Natural Ingredients Ltd.

- Dawn Foods Products, Inc.

- TruFoodMfg

RECENT DEVELOPMENT:

February 2023: ADM had acquired Comhan, a flavor distributor in South Africa, to strengthen the product portfolio with fruit and chocolate flavors for application in the bakery and confectionery industries.

August 2022: Cargill acquired Aalst Chocolate Pte. Ltd., a chocolate manufacturer, to expand its Asia Pacific footprint and add chocolate to its existing portfolio of cocoa products.