MARKET OVERVIEW- UNITED STATES OPTICAL SPECTRUM ANALYZER MARKET

An optical spectrum analyzer is used to measure and display the distribution of power of an optical source for a specific wavelength range. The most common application of an optical spectrum analyzer is characterization of optical components and testing optical signals in telecommunication networks. Optical spectrum analyzers are preferred in laser modes analysis, very high-resolution spectroscopic measurements, telecommunication device and system tests and other applications. Optical spectrum analyzers are widely used in telecommunications. This is due to its involvement in several applications such as light source characterization, optical amplifier assessment, WDM network analysis and OSNR measurement. The rise in adoption of 5G technology along with supportive initiatives encouraging automation is a key factor driving the demand for optical spectrum analyzers in the United States. Also, technological advancements in 5G technology is anticipated to drive the growth of the market in the region. Furthermore, the rise in implementation of strategic initiatives by key market players in the IT sector is anticipated to provide lucrative growth opportunities for key players operating in the market.

MARKET DRIVERS

The growth of the market is driven by rise in use of 5G technology. Many companies are focusing on implementing strategic initiatives to stimulate the adoption of 5G services in the U.S. This is a major factor driving the growth of the market in the U.S. For instance, in November 2021, DISH Wireless and Cisco announced a multi-layered agreement to accelerate 5G services in the United States. The partnership is designed to enable businesses to capitalize on DISH’s 5G network and application infrastructure to support new hybrid work models. In July 2021, Ericsson announced a landmark multi-year agreement with Verizon to provide its industry-leading 5G solutions to accelerate the deployment of Verizon’s world-class next-generation 5G network in the U.S. In May 2021, Ericsson and Leonardo partnered to explore and develop new 5G solutions and business models spanning industrial, public safety and critical infrastructure. In January 2021, VIAVI partnered with Mavenir to help optimise its advanced radio access systems with lab validation of 5G radio access technology for US mobile network operators (MNOs). Thus, high growth in 5 G technology has improved the efficiency of sending mails, watching videos, social media, and other activities, creating demand for optical spectrum analyzers. Moreover, automobile manufacturers are integrating 5G network in government-approved driverless vehicles and connected cars. This is expected to further fuel the market growth over the estimated time period.

MARKET OPPORTUNITIES

The market is expected to have new opportunities with the rapid growth of the IT and telecommunication sector, as telecommunication is considered one of the major end-users of optical spectrum analyzers. According to Statistica, in 2021, spending in the telecommunication services industry is expected to account for 1.45 trillion U.S. dollars, an increase of nearly 5% from 2020. By 2022, the telecommunication spending is expected to grow even further, reaching 1.505 trillion U.S. dollars. The revenue in Telecommunications is projected to amount to US$155.70bn in 2023.

MARKET RESTRAINTS

Some of the optical spectrum analyzers utilizes wavelength-dependent diffraction angles, while others contain some type of interferometer. A mostly acceptable wavelength resolution can be achieved by using a Fabry–Pérot interferometer as a wavelength-tunable bandpass filter. A fundamental limitation of Fabry–Pérots is that they have a quite limited free spectral range. Thus, such instruments are not appropriate as universal optical spectrum analyzers. It is expected to have a negative impact on the growth of the market.

MARKET GROWTH CHALLENGES

The maintenance of optical spectrum analyzers involves a significantly high cost. This is expected to negatively impact the growth of the market during the estimated time period. Furthermore, the COVID-19 pandemic has emerged as a major challenge for the growth of the market.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the United States Optical Spectrum Analyzer market including, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. A growing use of 5G technology has led to a rise in demand for optical spectrum analyzers, and therefore, the market is expected to witness growth at a specific CAGR from 2023-2029.

UNITED STATES OPTICAL SPECTRUM ANALYZER MARKET SEGMENTAL OVERVIEW

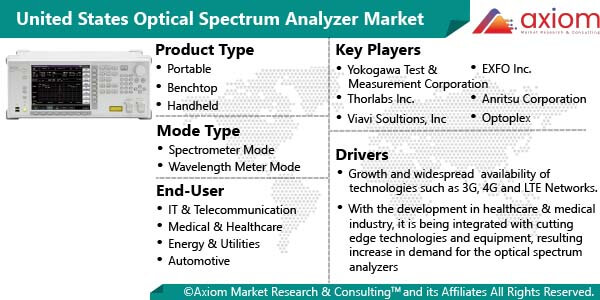

United States Optical Spectrum Analyzer market comprises of different market segments like product type, mode type, and end-users.

UNITED STATES OPTICAL SPECTRUM ANALYZER MARKET BY PRODUCT TYPE

On the basis of product type, the United States Optical Spectrum Analyzer market consists of key segments like

The benchtop segment is expected to gain the most market share over the forecast period. The growth of the segment can be attributed to high performance capability and spatial power distribution for visualization offered by benchtop optical spectrum analyzers. Additionally, the benchtop OSA’s have a wide range of wavelength starting from 600 nm to 1700 nm that makes them an ideal choice for use in IT and telecom industries. Additionally, factors like high resolution and precision, highest wavelength accuracy (10pm) and repeatability, stability (10mdB), high amplitude accuracy (0.5 dB), low polarization dependence (50mdB) fast sweep speeds to maximize throughput and their flexible settings are likely to support the growth of the segment.

Also, the portable segment is expected to witness high growth over the forecast period. High flexibility offered by portable optical spectrum analyzers is a key factor driving the growth of the segment.

UNITED STATES OPTICAL SPECTRUM ANALYZER MARKET BY MODE TYPE

By mode type, the United States Optical Spectrum Analyzer market includes segments like

- Spectrometer Mode

- Wavelength Meter Mode

The spectrometer mode segment is expected to lead the market over the forecast period. Spectrometer mode provides detailed, accurate and precise information about the spatial distribution of optical power in a wave. These types of devices show detailed information in the form of a graph where wavelength resides at the horizontal part also known as X-axis and power density resides on vertical part called Y-axis.

The wavelength meter mode segment is expected to witness high growth over the forecast period. The wavelength meter mode is in high demand from the IT and telecom industries, semiconductors and electronic industries, energy and utility industries, healthcare and hospitals as it helps in the short time detection of minimal errors if present in a particular wavelength.

UNITED STATES OPTICAL SPECTRUM ANALYZER MARKET BY END-USER

The United States Optical Spectrum Analyzer market finds major end-users like

- IT and Telecommunication

- Medical and Healthcare

- Energy and Utilities

- Automotive

- Aerospace and Defense

- Semiconductors and Electronics

- Others

The IT and telecommunication segment is expected to lead the market during the forecast period. In the IT and telecommunications sector, optical spectrum analyzers are used in places where dense wavelength division multiplexing (DWDM) is used to provide high data bandwidth over fiber optics.

The semiconductors and electronics segment is expected to witness high growth over the estimated time period. An increasing demand for optical spectrum analyzers in semiconductors is a major factor driving the growth of the segment.

COVID-19 IMPACT ANALYSIS ON THE UNITED STATES OPTICAL SPECTRUM ANALYZER MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors with regard to the United States Optical Spectrum Analyzer market. The report involves an exclusive study on COVID-19 impact analysis. In addition, the report also includes a complete analysis of changes in the United States Optical Spectrum Analyzer market, expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on United States economies, international trade, business investments, GDP, and the marketing strategies of key players present in the market.

The COVID-19 pandemic has severely disrupted trade and supply chains, leading to a negative influence on the global economy. Government imposed shut down of several manufacturing facilities has affected the growth of the market. Various industries such as semiconductors, automotive, aerospace, and others suffered a great loss during the pandemic. Also, the spectrum auction for 5G services were postponed by the U.S government, which has hindered the market’s growth. On the other hand, IT, and telecommunication industry has witnessed great internet traffic. This is expected to drive the demand for optical spectrum analyzers in the upcoming years.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the United States Optical Spectrum Analyzer market is primarily focused on expanding the growth of the optical spectrum analyzer industry in the United States with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in the optical spectrum analyzer sector has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the requirements of consumers, which is further contributing to healthy growth in the market.

The key players studied in the market are

- Yokogawa Test & Measurement Corporation (Japan)

- Thorlabs Inc. (United States)

- Viavi Solutions, Inc (United States)

- EXFO Inc. (United States)

- Anritsu Corporation (United States)

- Baysec (United States)

- Apex Technologies (France)

- Aragon Photonics (Spain)

- Finisar Corporation (United States)

- New Ridge Technologies (United States)

- ID Photonics GmbH (Germany)

- keysight (United States)

- Light Machinery (Canada)

- Optoplex (United States)

RECENT DEVELOPMENT:

June 2021: Viavi Solutions Inc. (VIAVI) introduced the mOSA Module, adding optical spectrum analysis to the VIAVI Multiple Application Platform (MAP) Optical Manufacturing Test system. The mOSA complements existing VIAVI solutions for optical power measurement, switching and signal conditioning, and test automation, further enhancing the industry's most comprehensive test portfolio for development and manufacturing of optical communications technology.

June 2021: Bristol Instruments announced offering software that converts 438 Series Multi-Wavelength Meter into a high-resolution optical spectrum analyzer. The model 438 offered the most accurate, effective, and adaptable WDM wavelength testing currently available, owing to features like high precision, measurement rate up to 10 Hz, and a wide operational range of 1000 to 1680 nm.