MARKET OVERVIEW- EUROPE SOLAR BATTERY STORAGE INVERTER MARKET

In a power system network, energy storage devices are used to store the surplus energy during the off-peak period and utilize the stored energy during peak period. Solar battery energy storage devices charge during the day when the sun is shining, and store and release power for consumption around the clock or on cloudy days. Battery energy storage is particularly effective when combined with solar energy, because solar energy storage mitigates the intermittent nature of renewable power and guarantees a steady supply of electricity. A solar battery storage inverter can help you track your system’s electrical generation so you can streamline and maximise your system’s power output. A rise in renewable energy production and favourable government regulations are expected to fuel the growth of the market in the region. Also, technological developments within the energy sector, along with new product launches, are anticipated to provide new growth opportunities for key players in the market over the forecast period.

MARKET DRIVERS

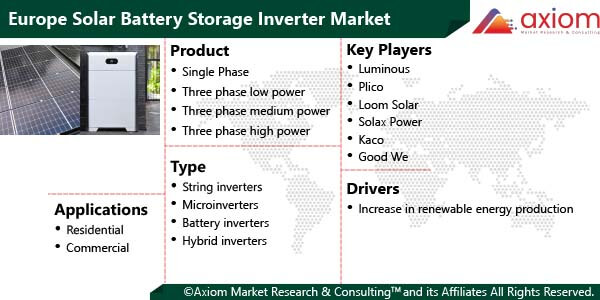

The growth of the market is primarily driven by an increase in renewable energy production in Europe. The European Union (EU) has reached a renewable energy share in final energy consumption of 22.1% in 2020, exceeding the 20% target proposed in 2009. According to the British think-tank Ember, 38% of electricity produced in the European Union came from green energy in 2020. This means by one percent more than fossil fuels, which cover 37% of the energy mix. The analysis, from independent energy think tank Ember, indicates that wind and solar produced 22% of the EU’s electricity over the year, while gas generated 20%. The report further shows that the rise in renewable electricity generation helped to avoid €10 billion ($10.89 billion) in gas costs. The largest increase in terms of renewables was seen in solar, which surged by 24%, delivering an additional 39-terawatt hours of electricity over the previous year. The increase in renewable energy production is a major factor that is anticipated to drive the growth of the market during the forecast period. Furthermore, innovation in energy storage technology is anticipated to further drive market growth over the estimated time period.

MARKET OPPORTUNITIES

The market is expected to witness promising opportunities with the implementation of innovative projects in the renewable energy sector. For example, in November 2021, a joint venture between TagEnergy, a global clean energy group, and UK-based Harmony Energy announced that they would jointly develop two battery energy storage projects in Scotland and England. Both projects will use the Tesla megapack multi-megawatt BESS technology. The Chapel farm near southern England has an electricity generation capacity of 99 MWh, while the Jamesfield farm near Scotland has a generation capacity of 98 MWh. Such innovative renewable energy projects are expected to create lucrative opportunities for key players in the market.

MARKET RESTRAINTS

Due to the high cost of solar power generation, a lot of the equipment used in a solar power plant has to be imported. This is expected to act as a hurdler for the growth of the market. Also, the shortage of essential raw materials is expected to negatively impact the growth of the market.

MARKET GROWTH CHALLENGES

A lack of knowledge and skill to install solar battery storage inverters is expected to be a major challenge for the market’s growth over the forecast period. Even though solar modules and other equipment have a life of about 25 years, the modules do get damaged and need to be disposed of. This contributes to the amount of solar waste in the country. This is expected to negatively impact market growth over the forecast period.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the Europe Solar Battery Storage Inverter market, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. An increasing production of solar energy is anticipated to stimulate the demand for solar battery storage inverter and due to this factor, the market is expected to witness growth at a specific CAGR from 2023-2029.

EUROPE SOLAR BATTERY STORAGE INVERTER MARKET SEGMENTAL OVERVIEW

The Europe Solar Battery Storage Inverter market comprises of different market segments like product, type, application and country.

EUROPE SOLAR BATTERY STORAGE INVERTER MARKET BY PRODUCT

By product, the Europe Solar Battery Storage Inverter market includes key segments like

- Single Phase

- Three phase low power

- Three phase medium power

- Three phase high power

The three-phase medium power followed by single phase power segment is anticipated to witness high demand over the estimated time period. A three-phase power supply can transmit three times as much power as a single-phase power supply, while only needing one additional wire (that is, three wires instead of two). Single phase power supply units have a wide range of applications. Loads that have a limited power need up to 1000 watts make the most efficient use of a single-phase AC power supply.

SOLAR BATTERY STORAGE INVERTER MARKET BY TYPE

By type, the Europe Solar Battery Storage Inverter market includes segments like

- String inverters

- Microinverters

- Battery inverters

- Hybrid inverters

The string inverter segment is expected to lead the market over the forecast period. String inverters are commonly used in residential and commercial applications. It is intended for immediate use because string inverters are primarily utilised in grid-based solar systems, meaning that whatever power isn’t used is pushed back onto the electrical grid.

The microinverter segment is expected to witness high growth over the estimated time period. A major advantage of micro-inverters is that they are designed to find the ideal voltage for each system and generate the maximum peak power voltage. Microinverters are expected to witness high demand as they aren’t capped by their lowest producing solar panel like string inverters.

EUROPE SOLAR BATTERY STORAGE INVERTER MARKET BY APPLICATION

The Europe Solar Battery Storage Inverter market finds major applications in

- Residential

- Commercial

- Others

The commercial segment is estimated to lead the market during the forecast period. The growth of the segment can be attributed to the large-scale use of solar battery storage inverters in various commercial applications. Increasing investments in renewable energy generation are expected to contribute to the growth of the segment. For instance, in December 2022, the European Commission approved the German government's 28-billion-euro ($29.69 billion) support scheme for renewable energy, which is aimed at rapidly expanding the use of wind and solar power.

The residential application segment is expected to witness high growth over the forecast period. The Solar Battery Storage Inverter is being widely used in residential spaces. Studies show that homeowners pay a premium for a solar home; one study by the Lawrence Berkeley National Laboratory showed that on average, solar increased the value of a home by about $15,000. Although market factors like electricity rates and system size may impact the size of the premium, solar homes can sell for more than homes without PV. It is expected to contribute to the growth of the segment.

EUROPE SOLAR BATTERY STORAGE INVERTER MARKET BY COUNTRY

The Europe Solar Battery Storage Inverter market is studied for the following countries

- Germany

- U.K

- France

- Italy

- Spain

- Rest of Europe

Germany is expected to dominate the market over the forecast period. High investment in renewable energy generation, and a rise in solar energy projects are key factors driving the growth of the market in the region. For instance, in December 2021, Enerparc signed a Power Purchase Agreement with RWE, the German power utility, for the development of a solar power plant in Lauterbach, Hesse, with a capacity of 57 mega-watt (MW). Around 125,000 solar modules will be installed on a 54-hectare site. The system is set to go into operation in the year 2022.

It is anticipated that the UK will witness high growth during the estimated time period. As of November 2021, the United Kingdom registered a total of 13.63 GW installed solar capacity, and 23.6% (3,218 MW) of the total installed solar PV capacity comes from installations below 10 kW, which primarily consists of residential rooftop solar photovoltaic consumers. About 91.9% of all installations are sub-4 kW. Thus, rising solar energy production is expected to drive the growth of the market in the country.

COVID-19 IMPACT ANALYSIS ON EUROPE SOLAR BATTERY STORAGE INVERTER MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors on the Europe Solar Battery Storage Inverter market. In addition, a complete analysis of changes on the Europe Solar Battery Storage Inverter market expenditure, economic and international policies on supply and demand side is provided in this exclusive report. The report also studies the impact of the pandemic on Europe economies, international trade, business investments, GDP, and the marketing strategies of key players present in the market.

According to the United Nations Environment Programme, the COVID-19 pandemic has created challenges for the economy and the energy sector, as well as uncertainty for the renewable energy industry. The pandemic impacted renewable energy manufacturing facilities, supply chains, and companies, slowing the global transition to sustainable energy. However, according to data from the Fraunhofer Institute for Solar Energy Systems ISE, the share of renewable energy in Germany’s power generation surged to 55.8% during the first half of 2020 amid a lower demand due to the decline in industrial activity caused by the Covid-19 pandemic and favourable weather. It is expected to provide significant growth opportunities for the market over the forecast period.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of Europe Solar Battery Storage Inverter market is majorly focused on expanding the growth of Solar Battery Storage Inverter industry in the Europe region with new product innovation, and business expansion. An increasing a range of manufacturers operating in the renewable energy sector has led to growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the required demand of consumers, which further contributes to healthy growth in the market.

The key players studied in market are

- Luminous

- Plico

- Loom Solar

- Solax Power

- Kaco

- Good We

- SMA Solar Technology AG

- SolarEdge

- Huawei

- Sungrow

- FIMER

- Delta

RECENT DEVELOPMENT:

June 2022: Germany solar PV inverter supplier SMA Solar Technology announced it will construct a new GW factory in Germany to expand its production capacity from 21 GW now to almost 40 GW by 2024, to primarily cater to large scale solar PV power plants. The new facility will be built at its headquarters in Niestetal near Kassel in Germany with construction planned to begin in late 2022 on 47,000 m2 floor space.

January 2022: SSE announced details of its first solar project that delivers 30 MW of clean energy as part of its ambitious GBP 12.5 billion investment program to power the transition toward net-zero. The 30-MW solar farm at Littleton Pastures is located near Evesham, Worcestershire. Once completed in late 2023, the 77-acre site can power about 9,400 homes.