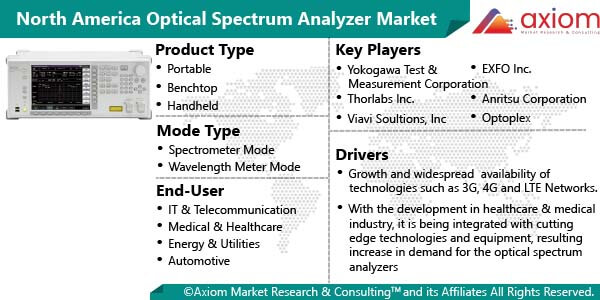

MARKET OVERVIEW- NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET

An optical spectrum analyzer is an instrument that quantifies and displays the power of an optical light source over a given wavelength range. Optical spectrum analyzers are ideal instruments for laser modes analysis, very high-resolution spectroscopic measurements, telecommunication device and system tests and other applications. The rise in initiatives encouraging automation is a key factor driving the demand for optical spectrum analyzers in North America. Also, high investments in 5G technology is anticipated to drive the growth of the market in the region. Furthermore, the rise in technological advancements in IT and telecommunications sectors are anticipated to provide lucrative growth opportunities for key players operating in the market.

MARKET DRIVERS

The growth of the North America Optical Spectrum Analyzer market is driven by the rise in use of 5G technology. In 2020, Apple released the first iPhones to support 5G connectivity, working with both mmWave and sub-6 GHz 5G. AT&T and Verizon both announced that their 5G service is available nationwide, with Verizon also indicating that its 5G Ultra-Wideband service (up to 4 Gbps) is available in parts of 71 cities. T-Mobile, which acquired Sprint in April 2020, added 2,000 towns and cities to its 5G network with the launch of its independent architecture. This increased the total of cities covered to over 7,500. In 2021, Ericsson, a leading 5G network service provider in Canada, had released the Canadian results from its largest consumer study to date. It shows that four million Canadian smartphone users plan to switch to 5G service in the next 12 to 15 months. Thus, high growth in 5 G technology has improved the efficiency of sending mails, watching videos, social media, and others, creating demand for optical spectrum analyzers. Moreover, automobile manufacturers are integrating 5G network in government-approved driverless vehicles and connected cars. This is expected to further fuel the market growth over the estimated time period.

MARKET OPPORTUNITIES

The market is expected to have new opportunities with the rapid growth of the IT and telecommunication sector, as telecommunication is considered one of the major end-users of optical spectrum analyzers. According to Statistica, in 2021, spend in the telecommunication services industry is expected to amount to 1.45 trillion U.S. dollars, an increase of nearly 5% from 2020.

MARKET RESTRAINTS

Optical spectrum Analyzers can be based on very different operation principles. Some of them utilizes wavelength-dependent diffraction angles, while others contain some type of interferometer. A mainly acceptable wavelength resolution can be achieved by using a Fabry–Pérot interferometer as wavelength-tunable bandpass filter. A fundamental limitation of Fabry–Pérots is that they have a quite limited free spectral range. Thus, such instruments are not appropriate as universal optical spectrum analyzers. It is expected to have a negative impact on the growth of the market.

MARKET GROWTH CHALLENGES

The maintenance of optical spectrum analyzers involves a high cost. This is expected to be a key economic challenge. Furthermore, the COVID-19 pandemic has emerged as a major challenge for the growth of the market.

CUMULATIVE GROWTH ANALYSIS

The report provides an in-depth analysis of the North America Optical Spectrum Analyzer market including, market size, and compound annual growth rate (CAGR) for the forecast period of 2023-2029, considering 2022 as the base year. A growing use of 5G technology has led to rise in demand for optical spectrum analyzers, and therefore, the market is expected to witness growth at a specific CAGR from 2023-2029.

NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET SEGMENTAL OVERVIEW

North America Optical Spectrum Analyzer market comprises of different market segments like product type, mode type, end-users and country.

NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET BY PRODUCT TYPE

On the basis of product type, the North America Optical Spectrum Analyzer market consists of key segments like

The benchtop segment is expected to gain the major market share over the forecast period. The growth of the segment can be attributed to high performance capability and spatial power distribution for visualization offered by benchtop optical spectrum analyzers. Additionally, the benchtop OSA’s have a wide range of wavelength starting from 600 nm to 1700 nm that makes them an ideal choice for use in IT and telecom industries. Additionally, factors like high resolution and precision, the highest wavelength accuracy (10pm) and repeatability, stability (10mdB), high amplitude accuracy (0.5 dB), low polarization dependence (50mdB) fast sweep speeds to maximize throughput and their flexible settings are likely to support the growth of the segment.

Also, the portable segment is expected to witness high growth over the forecast period. High flexibility offered by portable optical spectrum analyzers is a key factor driving the growth of the segment.

NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET BY MODE TYPE

By mode type, the North America Optical Spectrum Analyzer market includes segments like

- Spectrometer Mode

- Wavelength Meter Mode

The spectrometer mode segment is expected to lead the market over the forecast period. Spectrometer mode provides detailed, accurate and precise information about the spatial distribution of optical power in a wave. These types of devices show detailed information in the form of a graph where wavelength resides on the horizontal part also known as X-axis and power density resides on the vertical part called Y-axis.

The wavelength meter mode segment is expected to witness high growth over the forecast period. The wavelength meter mode is receiving high demand from the IT and telecom industries, semiconductors and electronic industries, as it helps in short time detection of minimal errors if present in a particular wavelength.

NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET BY END-USER

The North America Optical Spectrum Analyzer market finds major end-users like

- IT and Telecommunication

- Medical and Healthcare

- Energy and Utilities

- Automotive

- Aerospace and Defense

- Semiconductors and Electronics

- Others

The IT and telecommunication segment is expected to lead the market during the forecast period. In the IT and telecommunications sector, optical spectrum analyzers are used in places where dense wavelength division multiplexing (DWDM) is used to provide high data bandwidth over fiber optics.

The semiconductors and electronics segment is expected to witness high growth over the projected time period. An increasing demand for optical spectrum analyzers in semiconductors is a major factor driving the growth of the segment.

NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET BY COUNTRY

The North America Optical Spectrum Analyzer market is studied for the following countries:

- United States

- Canada

- Mexico

United States is expected to dominate the market over the forecast period. Rising investments in 5G technology is expected to drive the growth of the market in the U.S. For instance, in October 2020, the FCC established the 5G Fund for Rural America to invest up to $9 billion in Universal Service Fund to deploy advanced 5G mobile wireless services in rural America (including up to $680 million for deployment on Tribal lands).

Canada is expected to witness high growth over the forecast period. High investments in 5G technology is anticipated to drive the growth of the market in the region. For instance, in 2021, Canada's largest wireless companies spent almost USD 9 billion on a new 5G spectrum 2021. Rogers invested CAD 3.3 billion in the 5G spectrum, covering 99.4% of the Canadian population, making it the largest single investor in the 5G spectrum in the country. Bell spent USD 2.1 billion in the auction and TELUS USD 1.95 billion.

COVID-19 IMPACT ANALYSIS ON THE NORTH AMERICA OPTICAL SPECTRUM ANALYZER MARKET

Axiom MRC provides a 360-degree analysis of micro and macro-economic factors with regard to the North America Optical Spectrum Analyzer market. The report involves an exclusive study on COVID-19 impact analysis. In addition, the report also includes a complete analysis of changes in the North America Optical Spectrum Analyzer market, expenditure, and economic and international policies on the supply and demand side. The report also studies the impact of pandemics on North America economies, international trade, business investments, GDP, and the marketing strategies of key players present in the market.

The spread of COVID-19 has severely disrupted trade and supply chains between the countries, leading to a negatively influence on the global economy. Government imposed temporary or permanent shut down of several manufacturing facilities has negatively impacted the growth of the market. Various industries such as semiconductors, automotive, aerospace, and others suffered a great loss during the pandemic. Also, the spectrum auction for 5G services were postponed by several governments across the world, which has hindered the market growth. On the other hand, IT and telecommunication industry has witnessed great internet traffic. This is expected to drive the demand for optical spectrum analyzers in the upcoming years.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the North America Optical Spectrum Analyzer market is primarily focused on expanding the growth of the optical spectrum analyzer industry in North America with new product innovation, business expansion, and the increasing presence of a range of manufacturers operating in optical spectrum analyzer sector has led to the growing demand for the market. Besides, the market offers a range of products in different applications to fulfil the requirements of consumers, which further contributes to healthy growth in the market.

The key players studied in the market are

- Yokogawa Test & Measurement Corporation (Japan)

- Thorlabs Inc. (United States)

- Viavi Solutions, Inc (United States)

- EXFO Inc. (United States)

- Anritsu Corporation (United States)

- Baysec (United States)

- Apex Technologies (France)

- Aragon Photonics (Spain)

- Finisar Corporation (United States)

- New Ridge Technologies (United States)

- ID Photonics GmbH (Germany)

- keysight (United States)

- Light Machinery (Canada)

- Optoplex (United States)

RECENT DEVELOPMENT:

June 2021: Viavi Solutions Inc. (VIAVI) had introduced the mOSA Module, adding optical spectrum analysis to the VIAVI Multiple Application Platform (MAP) Optical Manufacturing Test system. The mOSA complements existing VIAVI solutions for optical power measurement, switching and signal conditioning, and test automation, further enhancing the industry's most comprehensive test portfolio for the development and manufacturing of optical communications technology.

June 2021: Bristol Instruments announced offering software that converts 438 Series Multi-Wavelength Meter into a high-resolution optical spectrum analyzer. The model 438 offered the most accurate, effective, and adaptable WDM wavelength testing currently available, owing to features like high precision, measurement rate up to 10 Hz, and a wide operational range of 1000 to 1680 nm.