COVID-19 IMPACT ANALYSIS ON GLOBAL FATTY AMIDES MARKET

The COVID19 is an unparalleled global public health emergency affecting almost every industry, and long-term impacts are expected to impact industry growth during the forecast period. In addition, Coronavirus disease (COVID19) is an infectious disease caused by the SARSCoV2 virus. In the wake of the recent COVID-19 outbreak, there has been a significant disturbance in most industries across the globe. While a few industries experienced a contraction in their production and businesses, others faced severe outcomes such as the shutdown of businesses and movement restrictions. Due to the effect of COVID-19 some of the players in the market have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees during this pandemic. The chemical and material sector has been noticing the adverse effects of the COVID-19 outbreak. For instance, in the case of India, the effect of COVID-19 on trade is estimated to be worse for the chemical sector with a loss of 129 million dollars, whereas the damage has been estimated at 64 million for textiles and apparel.

MARKET OVERVIEW- GLOBAL FATTY AMIDES MARKET

MARKET DRIVERS

Increasing demand for polyolefin films from food and beverage and packaging industries is expected to drive the demand for fatty amides. It is highly preferred in the food industry due to its ability to travel faster on a film surface. The demand for packed food has been increasing owing to high purchasing power and busy life style will fuel the growth of the fatty that amides market. Furthermore, the increasing use of polyolefin shrink films in food and beverages, pharmaceuticals, consumer goods and industrial packaging applications is further fueling the market. Also, increasing per capital income in developing countries and demand for personal care and cosmetic products is expected to fuel the market. Besides, increasing the demand for fatty amides in other applications including fabric treatment, cleaners, etc. will further boost demand for the fatty amides market in upcoming years.

MARKET GROWTH OPPORTUNITIES

Growing demand for fatty amides from end-users such as personal care, packaging industry, automotive industry, around the globe is creating opportunity for the market. Furthermore, the growing demand for slip additives from health care for offering better seal strength to the plastic packaging product is anticipated to foster market growth.

MARKET RESTRAINTS

Volatile processes of raw materials are restraining the growth of the global fatty amides market. Fluctuation in the price of raw materials will affect the product price for the manufacturer. High manufacturing costs will add up to the cost of the product, affecting market growth.

MARKET GROWTH CHALLENGES

The available of substitutes of fatty amide in plastics, paints and coating industries such as silicone based compounds is major challenge for fatty amides market.

CUMULATIVE GROWTH ANALYSIS

The report provides in-depth analysis of the global fatty amides market, market size, and compound annual growth rate (CAGR) for the forecast period of 2022-2028, considering 2021 as the base year. Increasing demand for polyolefin films from food and beverages industries which will fuel the growth of the fatty amides market. It is expected to witness a growth at a specific CAGR from 2022-2028.

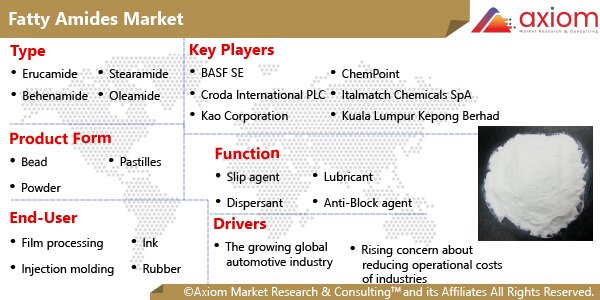

MARKET SEGMENTAL OVERVIEW

The global fatty amides market comprises of different market segment like type, product form, function end-users and geography.

FATTY AMIDES MARKET BY TYPE

By type, the fatty amides include key segment of

- Erucamide

- Behenamide

- Stearamide

- Oleamide

The types studied in the global fatty amides market are, erucamide, behenamide, stearamide, and oleamide. The Erucamide segment accounted for the largest share in the fatty amides market. In 2021, the erucamide accounted for 74% in terms of revenue owing to its application in the case of lubrication and as a slip agent, decreasing the friction in the polymer and plastic industry. Erucamide is produced by reacting erucic acid with gaseous ammonia. Owing to its ability to reduce the coefficient of friction on the film surface, also it considered a slip agent for polyolefin. Furthermore, increasing growth of the polymer and plastic industry is expected to boost the demand for erucamide.

FATTY AMIDES MARKET BY PRODUCT FORM

By product form, the fatty amides include key segment of

The product forms of fatty amide are bead, powder and pastilles. The bead segment accounted for the largest share in the fatty amides market. In 2021, the bead segment accounted for 61% in terms of revenue due to its demand from various end-user industries such as film processing, printing, ink manufacturing and others. Beads are mainly used in thermoplastics to improve their properties such as lubricity, anti-blocking and mold release. Oleamide and behenamide are available in beads. Oleamide beads are used as a lubricant and they are used as a slip agent and corrosion inhibitor. Moreover, behenamide is also available in bead form and it adds anti-blocking properties to polymers.

FATTY AMIDES MARKET BY FUNCTION

By function, the fatty amides include key segment of

- Slip agent

- Dispersant

- Lubricant

- Anti-block agent

- Release Agent

The functions studied in the global fatty amides market are, slip agent, dispersant, lubricant, anti-block agent and release agent. In 2021, the slip agent segment held a significant share in the fatty amides market. Fatty amides find applications as slip agents for plastic films, which are used in food packaging. The growing demand for fatty amides as slip agents is attributed to factors such as slip additives, which are mostly preferred to reduce friction in polyolefin film while processing. The rise in disposable income and growth in the middle-class population, the demand for packed food has increased, which fuels the demand for fatty amides as slip agents in the film processing industry.

FATTY AMIDES MARKET BY END-USERS

By end-user, the fatty amides include key segment of

- Film Processing

- Injection Molding

- Ink

- Rubber

The fatty amides market finds its application into film processing, injection molding, ink and rubber. Film processing accounted for the largest share in the fatty amide due to growing film processing industry and increasing disposable income and rising demand for packed food.

FATTY AMIDES MARKET BY GEOGRAPHY

The global fatty amide market is studied for the following region

- North America

- Europe

- Asia-Pacific

- Rest of the world (RoW)

The global fatty amides market is studied for key regions such as North America, Europe, Asia Pacific and the Rest of the World. Asia-Pacific is likely to dominate the global fatty amides market with a share of more than 37%, followed by Europe and North America. Improving economic conditions, increasing disposable income and positive demographics such as the increasing population and rising per capital income in the region boost the fatty amides market. Furthermore, there is high demand from the packaging and manufacturing industries, which fuels the demand for fatty amides. The growing demand for polyolefin films from the packaging and food and beverage industries.

COMPETITIVE LANDSCAPE ANALYSIS

The competitive landscape analysis of the fatty amides market is certainly based on the range of market players operating in the market, with an increasing demand for polyolefin films from food and beverage and packaging industries is expected to drive the market growth. Besides, a number of market players offer a wide range of products for different applications in various geographic locations. The market has major competitive analysis based on new product launches as well as other developments.

The key players studied in market are

- BASF SE,

- Croda international PLC,

- ChemPoint,

- Itlmatch chemicals SpA,

- Koa Corporation,

- Kuala Lumpur Kepong Berhad,

- Nippon Fine Chemical con., Ltd,

- PMC Biogenix, Inc,

- Pukhraj Additives

Recent Development:

September 2018: Dow Performance Silicones, a new silicone-based slip additive for low-density polyethylene (LDPE) film that optimizes form-fill-seal (FFS) packaging production. Such innovation in slip additive will favor market growth in upcoming year.

October 2018: Univar Inc. a chemical and ingredient distributor and provider of value-added services announced that it’s a wholly-owned subsidiary, ChemPoint. Com, Inc has expanded its partnership with PMC Biogenix to include distribution of PMC’s slip agents, anti-block additives and fatty acids in Mexico.